|

We mostly buy existing MultiFamily apartments here at Zovest. We are exploring avenues to do new development of MultiFamily in markets where the cap-rates shrunk so much that prices of 1960's to 1980's properties have skyrocketed, that it makes sense to do new construction instead of renovating old ones.

We are going through a process of new development in couple of markets and this is what we learn till now. 30,000 feet overview of phases. 1) Identifying the Raw Land which can be non-residential/ non-commercial 2) Entitling/ Rezoning the land to do residential/ commercial medium to high density 3) Going horizontal by grading the land, laying roads and adding utilities like electricity 4) Going vertical by constructing the building Phase 1) Identifying the Raw Land which can be non-residential/ non-commercial The first step to pursue new development/ construction is to select the markets/ sub-markets/ neighborhoods. Please refer to our earlier blogs to identify them. Other than that, you also need to find out the absorption rate which tells you how many new units are getting absorbed (rented) into the market with existing inventory. If absorption rate is low it will be difficult for the new units you are building to be rented. Typically if population in that market is growing more than double the national average, then it make sense to build in that market as a long term strategy. Once you identify that location, we have to find any raw land which might be zoned non-residential or non-commercial or residential low density housing (low number of dwelling units per acre). For example, we are looking a land which is zoned a single family home for each 10,000 sq ft of land. This is really low density. Phase 2) Entitling/ Rezoning the land to do residential/ commercial medium to high density Once you find that raw land from #1 above, you need to go to city/ planning commission to apply for rezoning or entitling the land to make it medium to higher density. First, you need to identify if the land is suitable for development, make sure any environmental issues or grading issues that prevents new development. Second, you need to setup a neighborhood meeting to take their concerns of a new development. Third, submit an application with city to request for rezoning to medium to higher density or ask for commercial from residential or other ways of rezoning based on requirement. Phase 3) Going horizontal by grading the land, laying roads and adding utilities Once the land is rezoned then we have to grade the land to make sure the land is flat for development by removing all high and low spots, lay the roads based on site plan, add utility connections like electricity, water and sewer lines, make the land pad ready so we can do actual construction of buildings. Phase 4) Going vertical by constructing the building Since each building pads are ready, we can start constructing each building or construct multiple buildings at a time. Usually there will be phased approach so homes/ buildings can be constructed to sell or rent in a timely manner. This will help in not waiting till end of completion of the project to start selling/ renting. Zovest will be doing new developments in future. Please reach to me at rama@zovest.com to know more about the phases of development. Thanks Rama Krishna

0 Comments

There are 2 types of renters. Those cannot afford to buy home and its their necessity to rent a house or condo or apartment or mobile home park. Other type is who can easily afford a home but their choice is to rent due to several factors like mobility, single and haven't formed household yet, don't want to deal with home owner issues, make it as an expense etc. We will dig deep into each category of renters and how to analyze them as an investment/ operator perspective.

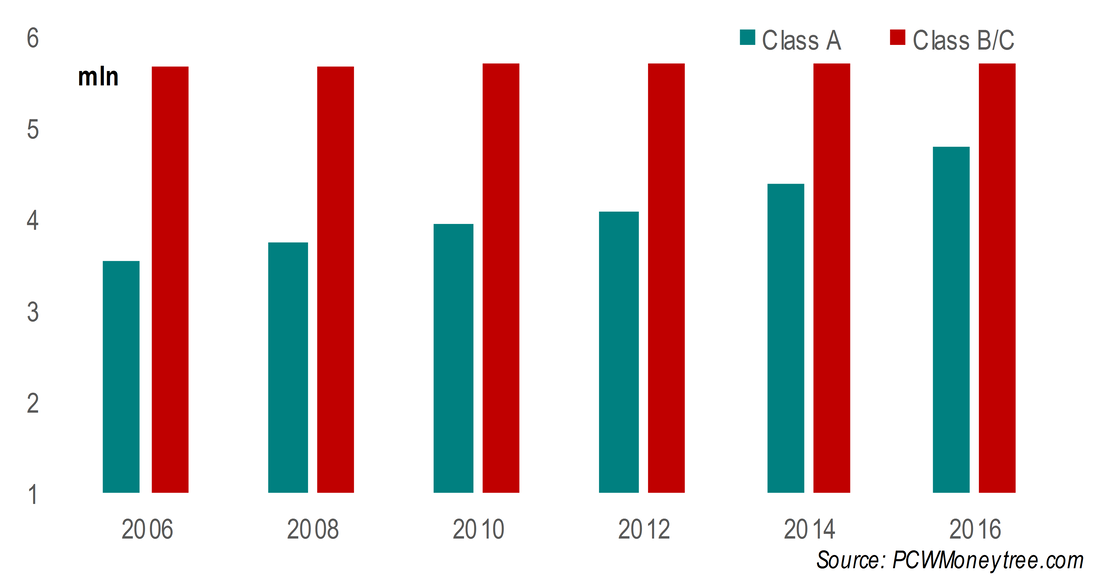

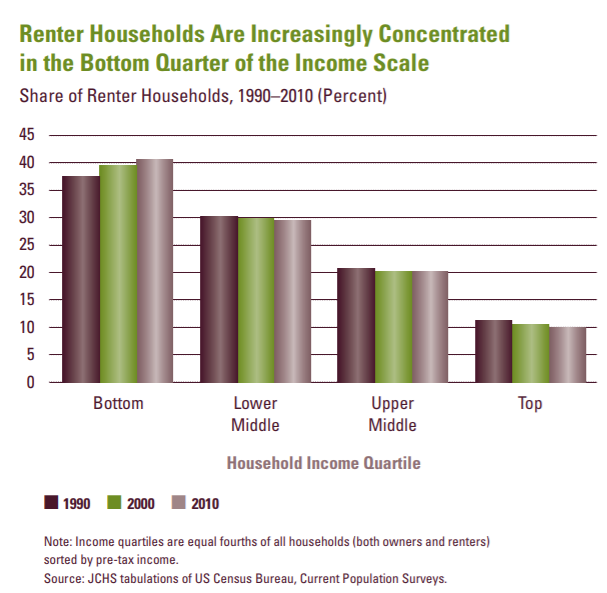

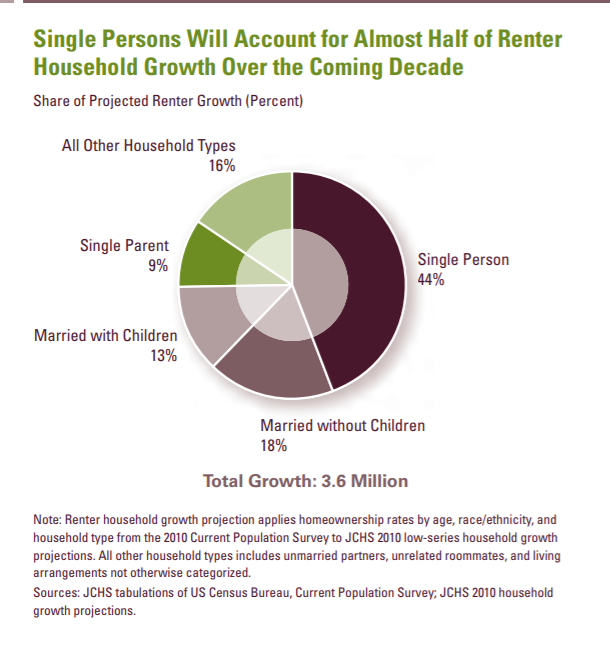

Renters by Necessity: 1) Mostly working professionals. Gray collar house holds such as policemen, fire fighters, teachers, people working in government. They look for reasonable amenities, good location, good schools, transportation facilities. (B, B- class properties come under this category) 2) Another segment for Renters by Necessity are blue collar workforce, who look for lower rents who primarily go after older assets and may be fewer amenities. (C-, C, C+ properties come under this category) The reason for renters in this category are due to not adequate credit score, not much saved for down payment, single income households, just started family, affordability etc. There is another segment in renters by necessity which are in affordable housing, where their income is lower than AMI (average median income) in that area and depend on subsidized housing. Renters by Choice (Lifestyle): 1) Working professionals, lifestyle renters, high income earners, DINK (Double Income No Kids) households who require high end finishes like in condos with more amenities to fit the social experience, common areas etc. (B+, A- properties come under this category) 2) Renters who command resort style living and amenities, exceptional details, luxury single family home level quality. They can easily afford homes but chose not to buy due to several reasons like lifestyle, don't want to deal with owning a home, mobility, rental expenses paid by company, proximity to really good location etc. (A, A+ properties come under this category) We as a value-add syndicator wants to be in Renters by necessity space but only in higher class like C+, B. We also look into renters by choice in B+ space only if the rents are really low, if there is a possibility to add more amenities and increase the level of interiors to say Gold level package. Overall rent growth is higher in renters by necessity segment from past few years. Some graphs for our analytical readers: 1) Find the number of Class A vs B/C apartment units in the market over time. 2) Renters and their income scale. 3) Renters and their households. Sources: Yardi Matrix, Zillow, US Census, Harvard Renter Study Interested to learn about MultiFamily Investments, please setup a quick call to go over your investment strategies. https://calendly.com/retirezovest/30min Thanks, Rama Krishna rama@zovest.com Last two month we saw how we select our markets and sub-markets. This is last part of the series where we list all aspects of how we select our properties.

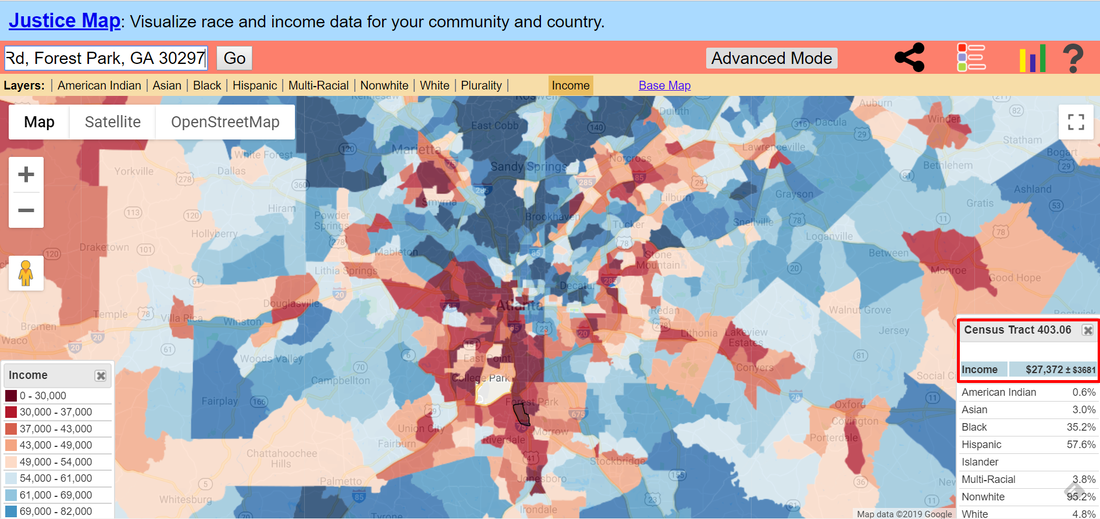

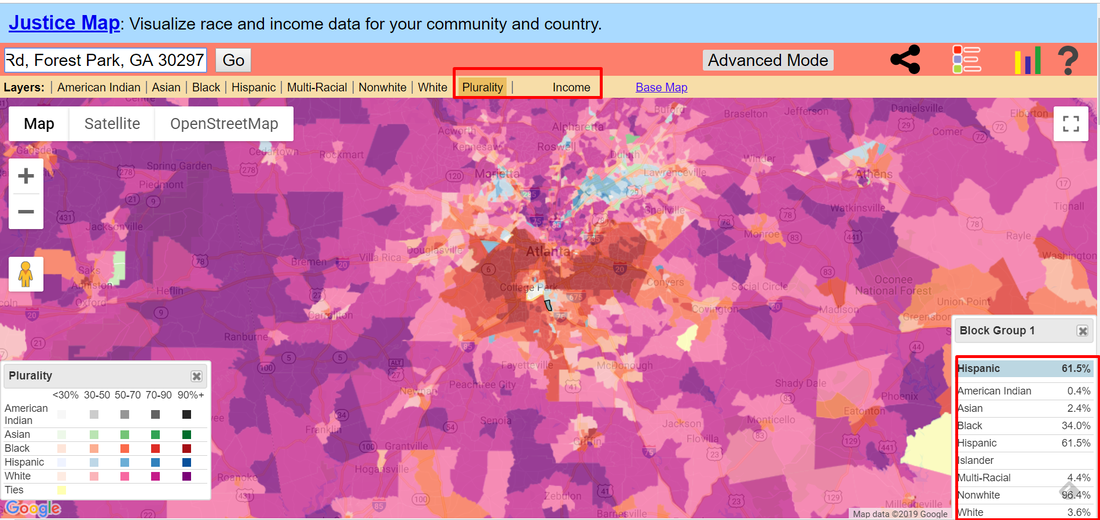

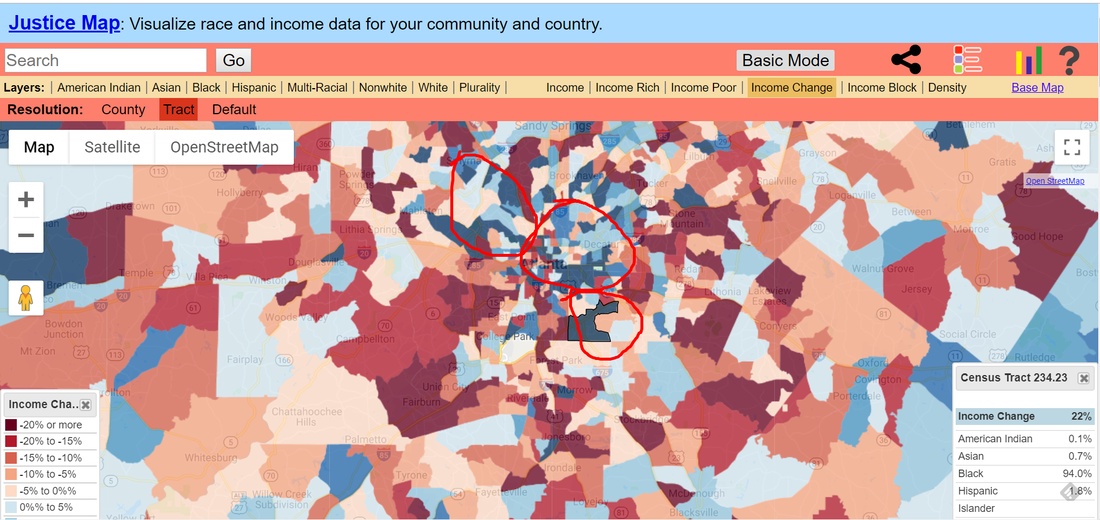

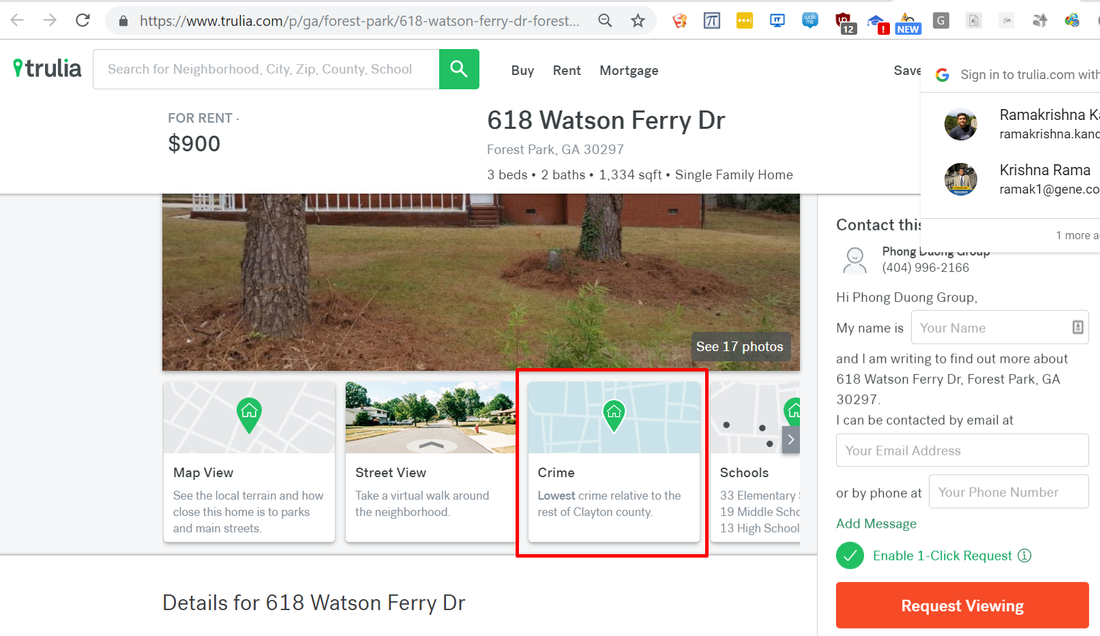

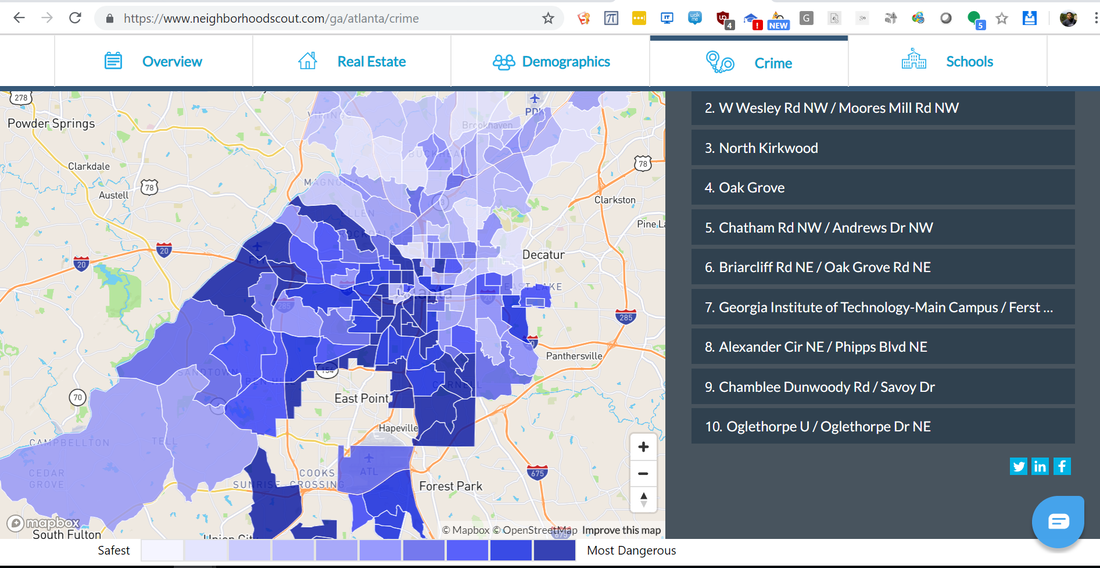

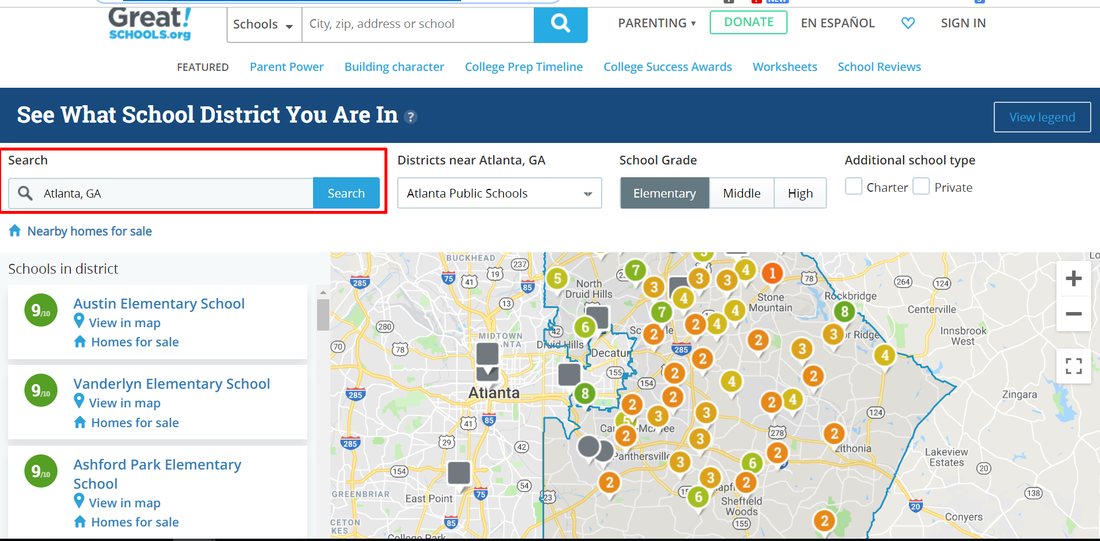

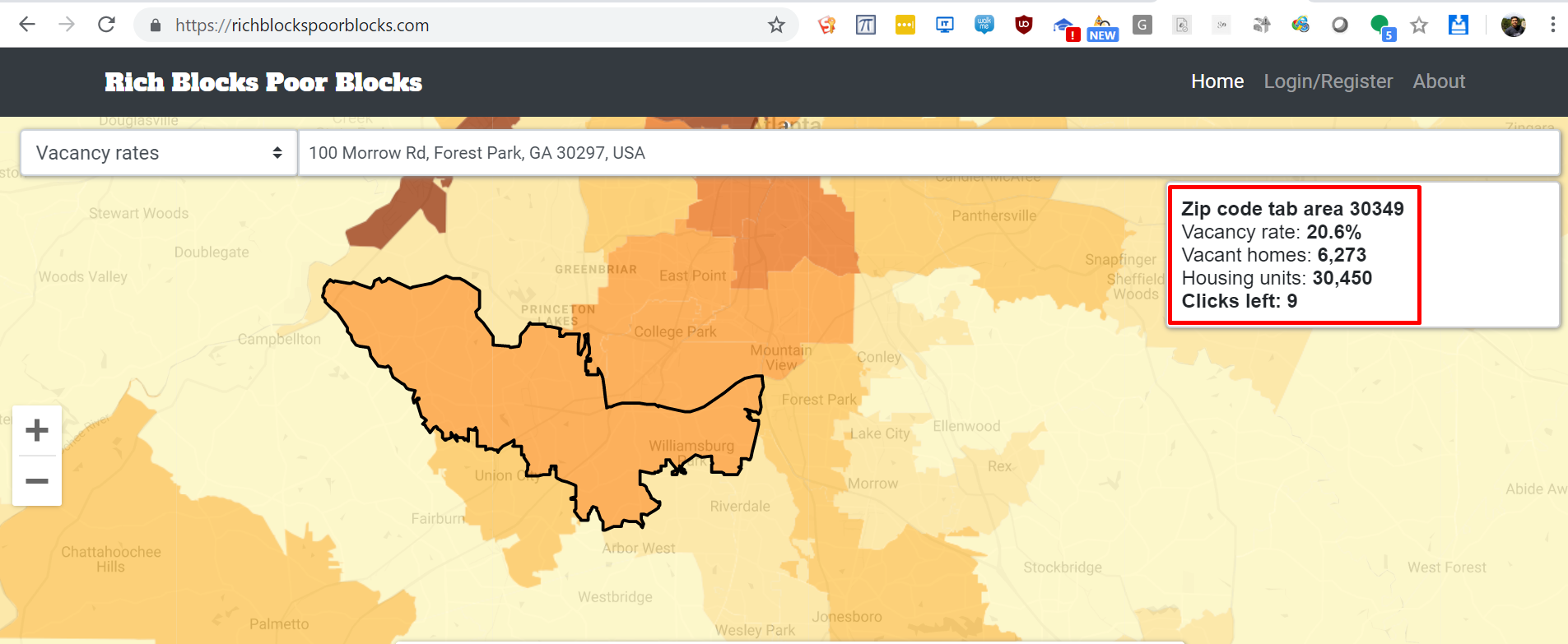

Note: The information is provided only for education purpose only. Don't make any purchasing/ investment decisions based on the blog or any content in this website. Please consult professionals in every area before proceeding. 1) Property Characteristics like Year of construction, Roofs (Pitched or Flat), Type of construction (Concrete Block or Brick or Wood Frame), Exterior Deferred Maintenance 2) Location/ Area Characteristics like School District Ratings, Crime in the area, Proximity to Major Retail, Vehicles per day (VPD), Single Family Home Prices nearby, Median Income in the census block, Demographics mix in the census block 3) Number of Units 4) Unit Mix 5) Number of Renovated vs Classic units and Rent Difference 6) Rent Roll, move-ins and Occupancy History 7) Utilities 8) FEMA Flood Zone 9) Rental and Sales Comps 10) Ability to add/ update amenities 1) Property Characteristics The first thing we get a deal in our desired market/ sub-market as per our previous 2 months blog posts to our desk, we look at the property characteristics. What is the year of construction of the property? Is it in the 1960's or 70's or 80's or later is really important because of several reasons like 60's and 70's have higher maintenance costs, asbestos, wiring and plumbing issues because of materials used at that time. Flat roofs have lower life expectancy than pitched roofs. Is it concrete block or brick or wood frame construction. Concrete block will stay for really long time where as wood frame has lot of upkeep. What is the exterior deferred maintenance on the property? As an operator you want to see if all external issues are fixed and go ahead and renovate the interiors of the property to increase rents to the market. 2) Location Characteristics The next thing we see is the exact census block and see how the crime is, can median income support the rents you are planning to increase to, demographic mix, nearby single family home prices, school ratings, vehicles per day in nearby freeway/ street, proximity to major retails and some even do the Starbucks rule. 3) Number of Units The number of units makes really important difference on how you want to operate the property. If its less than 80, you might not have ability to put onsite staff and you have to find a property manager who can operate without onsite staff. If its 80+ and preferably 160+ you have greater economies of scale to operate it efficiently and economically. 4) Unit Mix The unit mix is crucial as you don't want to buy a property with 80% of 1-bed room units. Ideally you should see a even unit mix of 1, 2 and 3 (or even 4) bedroom units. 5) Number of renovated vs classic units and rent difference that is achieved If higher number of units are already renovated, its a turnkey property and you have to rely on market rent growth or burning the loss-to-lease to increase value. Instead having lot of classic units with ability to increase rents to market will give you enough cushion to play the game effectively. 6) Rent Roll, Move-ins and Occupancy history Analyze the rent roll diligently or outsource this to a financial due diligence company. Because of lot of the times when you see lot of move-ins in the last 2 to 3 months, there might be a chance that seller just filled in people with concessions and/ or even bad quality tenants to reach higher occupancy before selling. Historic occupancy will give you lot of insights of the property performance. 7) Utilities Utilities and how they are charged is key component in selecting/ future operations of the property. Is electricity directly paid by tenants? Is water/ sewer is directly paid or sub-metered or rubbed back (RUBS - Ratio based Utility Billing System) to tenants? Is RUBS already implemented or can be implemented? (Because RUBS is market/ sub-market driven and you cannot enforce it if everyone else is doing all-bills-paid system). Do they charge for trash or can you implement value-trash feature? Utilities is one of the biggest expense in operating a MultiFamily. You shouldn't dabble or take a wrong decision in underwriting a property in this aspect. 8) FEMA Flood Zone Please take 10 seconds to go to FEMA website and put the address to see if the property is in flood zone or not. This will save you a lot of time/ money/ effort. https://msc.fema.gov/portal/search#searchresultsanchor 9) Rental and Sales comps Analyze Rental comps using Costar, Rentometer, Zillow, Padmapper, Craigslist etc tools to make sure the current rents are below market. Analyze Sales comps using Costar, Reonomy, Assessor websites to verify if you are buying in-line with sales happening around the area 10) Ability to add/ upgrade amenities If you especially looking at workforce housing and renters by necessity, you have to make sure what amenities that you can add/ upgrade. Can you add washers/ dryers in each unit? Do you have space to add children play area, bar-b-q, dog park? With Gen-X, WiFi area, co-working spaces, bike parking, gym and fitness center, game rooms, hangout spots, vending machines, laundry drop off, mailbox pickups etc are getting popular. Hope you enjoyed our series. We will do a webinar and also a mini-course on these 3 parts. Happy the 4th, Rama Krishna rama@zovest.com Part 2 - How we select our Sub-Markets/ Neighborhoods Last month we saw how we select our markets. Which is really important to narrow down an MSA (Metropolitan Statistical Area). But it's equally important to select right Sub-Markets/ neighborhoods/ census block. Its extremely difficult to be perfect but anyone who is buying large properties has to at least know the facts before selecting. So one can underwrite it correctly. Note: The information is provided only for education purpose only. Don't make any purchasing/ investment decisions based on the blog or any content in this website. Please consult professionals in every area before proceeding. 1) Median Income 2) Demographic Mix 3) Path of progress 4) Crime 5) Schools 6) Public Transportation 7) Close to Retail 8) Percentage of Renters/ Owners 9) Single-Family home prices nearby 10) Vacancy rates 1) Median Income Median income in the 5-mile, 3-mile, 1- mile and census block level is really important to identify good sub-markets. General rule of thumb is to avoid sub-markets and blocks which are less than 45k Median Income. Easiest way to find median income is from census data aggregators like City-Data.com or JusticeMap.org. I particularly like JusticeMap.org because you can give address and it gives you Demographics and Median Income of exact census block. Below you can see Median Income of an Apartment Complex in Atlanta by providing address. And also you can see what the good and bad parts of Atlanta. Between, you can still buy in blocks where median income is low, but make sure you underwrite properly and also assume that you have lot of delinquencies, bad debt, turnover etc. 2) Demographic Mix Also it's important to have good mix of Demographics in that block/ sub-markets. See demographics mix of a property in Atlanta using JusticeMap. 3) Path of progress There are several ways to identify if the area is in path of progress like City is doing any developments in that area. If private money coming into that area. If it's part of Opportunity Zone. If it's in gentrifying area. One of the easiest way to find if the median income is increasing. Again using JusticeMap, please go to Advanced mode and select Income change and you can identify the blocks where income is going up. 4. Crime Crime is really important factor when you consider buying a property in a sub-market or neighborhood. This will have direct impact on your bottom line and how you can operate a property. I use Trulia to check the address and see if its Lowest, Moderate or Highest crime area. Or Neighborhood Scout map to identify if that sub-market is Safest to Most Dangerous. https://www.neighborhoodscout.com/ga/atlanta/crime 5) Schools Good schools is one factor where you can pay premium to the apartment because of several factors like families live in those Apartments and they stay long term. Crime is also relatively low near good schools. Great Schools website has really good feature where you can key in the address and it gives you schools for that property. https://www.greatschools.org/school-district-boundaries-map/ 6) Public Transportation If the property is near public transportation like Metro, Subway etc the rentability of the Apartment will be higher. Because of more urbanization, public transportation access will be a major plus. 7) Close to Retail Close to retail, restaurants, office space is a really good as people are preferring live, work, play type of environment. Some investors prefer the Starbucks rule where the proximity of the property to a Starbucks will give the confidence that this is good area as Starbucks itself does several proprietary analysis to launch a new location. 8) Percentage of Renters/ Owners You need to know what is the percentages of renters vs owners in that sub-market or block. If there are 90% of renters might not be a good idea. As there are so many Apartments/ Rental units to choose and also there is no pride of ownership in that area. So a good mix of renters and owners is better. US average is 36% renters and 64% home owners. Note: Current Home ownership is lowest in the history. 9) Single-Family home prices nearby Average single family home prices nearby the property is also good indication if you want to buy that property or not. If you are buying an Apartment at 100k a door and if average home prices in that area is 150k, then it's not a good deal. For a 100k a door, the median home prices better to be around 350k or more. 10) Vacancy rates Rental vacancy rates from census data or USPS data is really important factor to consider buying a property as you need to underwrite it appropriately for that block or sub-market. Several paid tools can give you the data and one of the tool is Rich Blocks Poor Blocks. https://richblockspoorblocks.com/ Please let me know any questions.

Thanks Rama Krishna rama@zovest.com Part 1 - How we select our States/ Markets

These are the following Attributes we look when selecting states/ cities/ MSA's

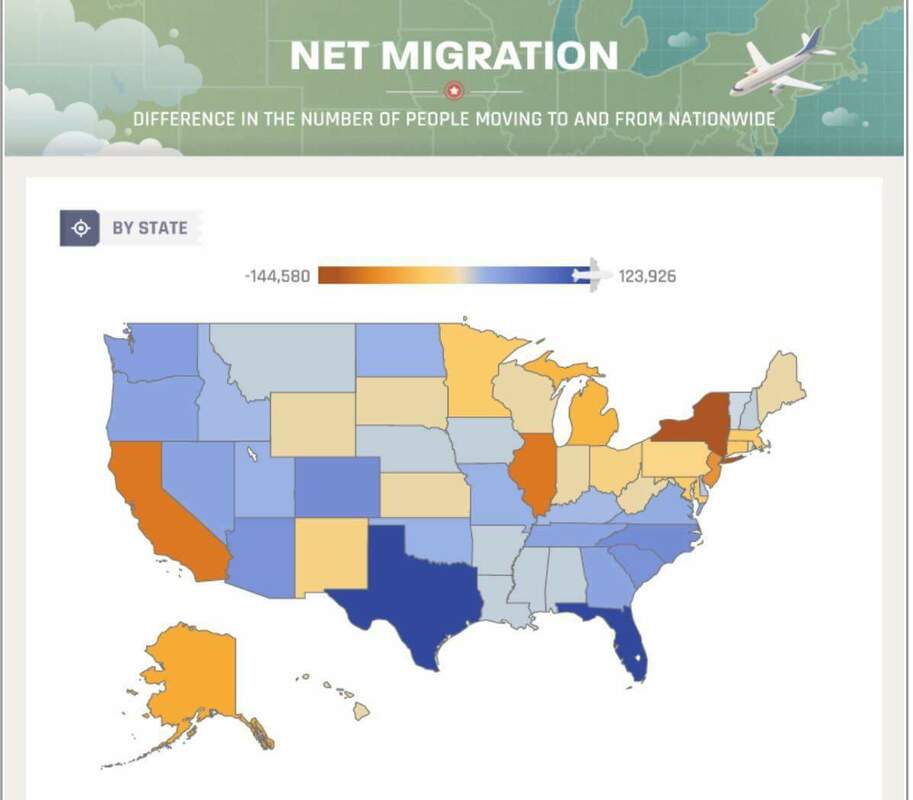

Note: The information is provided only for education purpose only. Don't make any purchasing/ investment decisions based on the blog or any content in this website. Please consult professionals in every area before proceeding. 1) Above average Population Growth 2) Above average Job Growth 3) No income tax states 4) Low property or overall tax states 5) Landlord Friendly States 6) High Average Home Price/ Average Annual Rent ratio 7) Decreasing Trend in overall crime in the market/ state 8) City/ County/ State doing any developments to improve infrastructure 9) Minimum population 250k (Preferably 500k or above) 10) Safety of the City. Community/ No severe weather/ natural calamities/ Financial Safety. 1) Above average Population Growth The population growth of the Market (City or MSA) should be above the national average. Census Bureau Reveals Fastest-Growing Large Cities where you can identify top cities. https://www.census.gov/newsroom/press-releases/2018/estimates-cities.html Also you can see net migration happening between states:

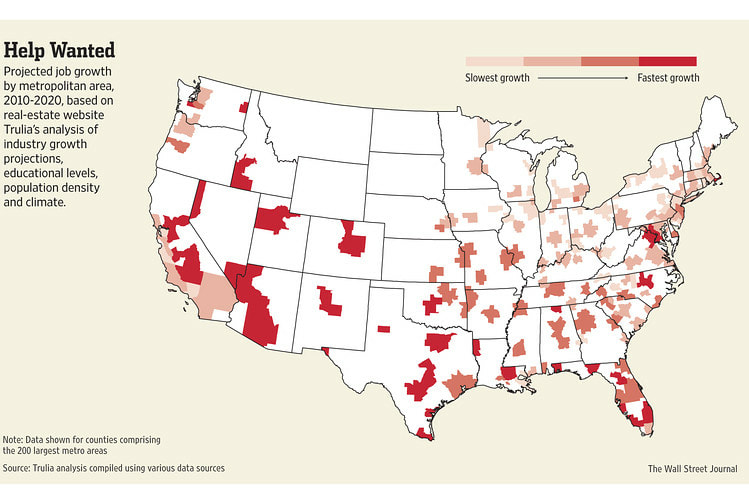

2) Above average Job Growth

Job growth actually is in conjunction with population growth. If more jobs are coming more population will move and vice-versa. Find below WSJ's projection of job growth from 2010 to 2020.

3) No income tax states

Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee have no income tax. Lot of people moving into some of these no income tax states as they can save on taxes. But need to make sure you pick the right states where population and jobs are actually growing. Just no income tax doesn't mean its a good state/ market to invest. 4) Low property or overall tax states Low property taxes can be better for an Apartment Operator where the expenses are lower. But its really important to know that property taxes as home owner might be different than a landlord. You need to find it out from tax assessor before underwriting a deal. Find all the states from lowest to highest property taxes: Source: https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/ As per Wallet Hub, "Tax season can be stressful for the millions of Americans who owe money to Uncle Sam. Every year, the average U.S. household pays nearly $11,000 in federal income taxes. And while we’re all faced with that same obligation, there is significant difference when it comes to state and local taxes. Taxpayers in the most tax-expensive states, for instance, pay two times more than those in the cheapest states. Surprisingly, though, low income taxes don’t always mean low taxes as a whole. For example, while the state of Washington’s citizens don’t pay income tax, they still end up spending over 8% of their annual income on sales and excise taxes. Texas residents also don’t pay income tax, but spend 1.74% of their income on real estate taxes, one of the highest rates in the country. Compare these to California, where residents owe almost 5% of their income in sales and excise taxes, and just 0.75% in real estate tax." Source: https://wallethub.com/edu/best-worst-states-to-be-a-taxpayer/2416 Property Taxes by State

Source: WalletHub

States with the Highest & Lowest Overall Tax Rates

Source: WalletHub

5) Landlord Friendly States

Operating in a landlord friendly states is extremely important factor when buying Apartments. As a landlord you need to make sure you know the laws of eviction, rent control, essential services etc. Investing without knowing these will be most expensive mistake. See interactive US map where you can hover and see if a state is landlord-friendly or renter-friendly.

6) High Average Home Price/ Average Annual Rent ratio

As per Rentberry: Price to Rent Ratio = Average Property Price/Average Annual Rent Example: Philadelphia, PA

Price to Rent Ratio = 18 The price to rent ratio is classified into three ranges: 15 and below: If the price to rent ratio is 15 or below, this means that from a financial point in your housing market it is better to buy a home rather than rent one. Property prices are cheap relative to rents. 16-20: In a market where the price to rent ratio ranges between 16 and 20, it is usually better to rent rather than to buy real estate. Property prices are rather high compared to rental rates. 21 and above: Finally, if you are located in a market where the price to rent ratio exceeds 21, you should definitely rent a property and not buy a home. Property prices are too expensive compared to rents, so renting is the more sound financial decision. So you have to identify markets which have higher price/ rent ratio: https://rentberry.com/blog/highest-prices-markets-us 7) Decreasing Trend in overall crime in the market/ state Make sure the overall crime index in the market/ state is in downward trend. This is really important to see if the market/ state is going in right direction. City-Data can give the crime index of each market from past 10 to 20 years. You can see if the trend is decreasing: http://www.city-data.com/city/Dallas-Texas.html 8) City/ County/ State doing any developments to improve infrastructure Inquire if the city/ county/ state are doing any massive developments or infrastructure improvements so it will be beneficial for your investments. 9) Minimum population 250k (Preferably 500k or above) Try to buy in larger MSA's as it will be easier to trade/ sell later. If population is say 5000 it might be difficult as there are no investors interested in that market. 10) Safety of the City. Community/ No severe weather/ natural calamities/ Financial Safety See if that market doesn't have severe weather or numerous natural calamities in the past which effect your operations, insurance requirements and returns to investors.

Source: WalletHub

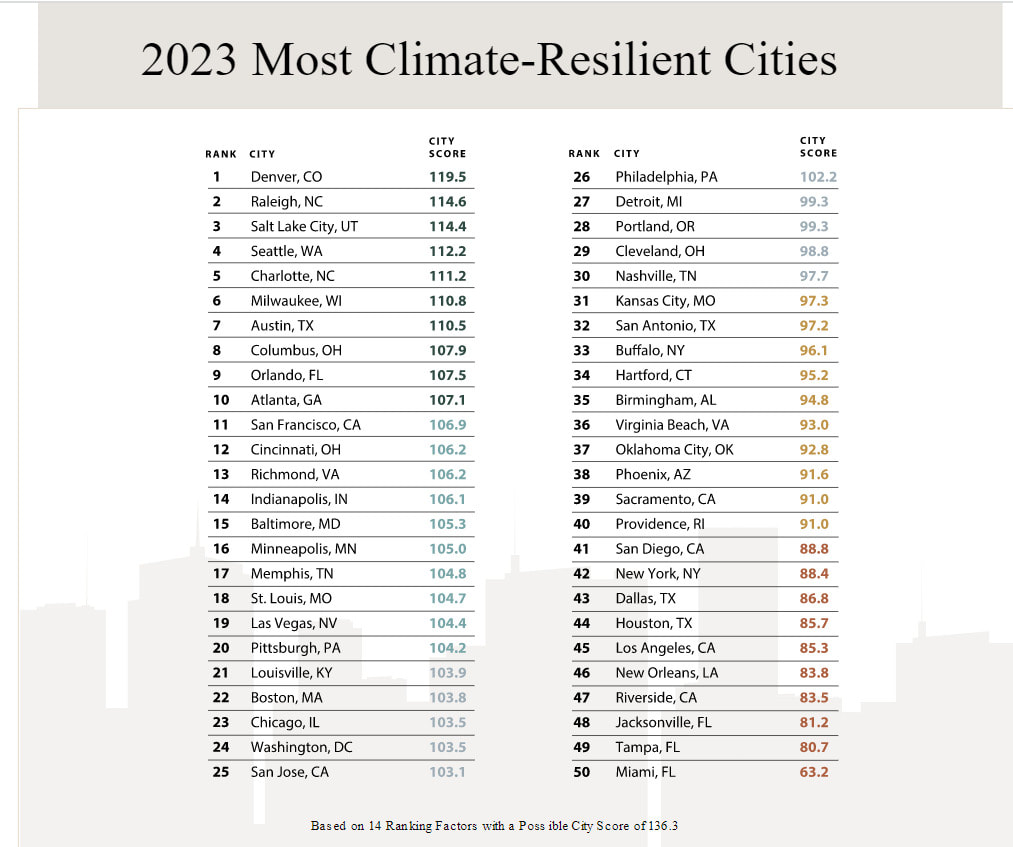

Climate Resilient Cities (No severe weather/ natural calamities)

"Unfortunately, there’s nowhere to hide from the effects of climate change. Every region in the United States has experienced rising temperatures, extreme weather patterns, and greater damage from natural disasters. Most experts predict that many areas will be unlivable by 2050, which is well within the scope of a 30-year mortgage. While some U.S. cities are better prepared to weather climate change’s effects, other locations are more likely to suffer based on geography and a lack of infrastructure and preparation." Source: https://www.architecturaldigest.com/reviews/home-improvement/most-climate-resilient-cities

Source:

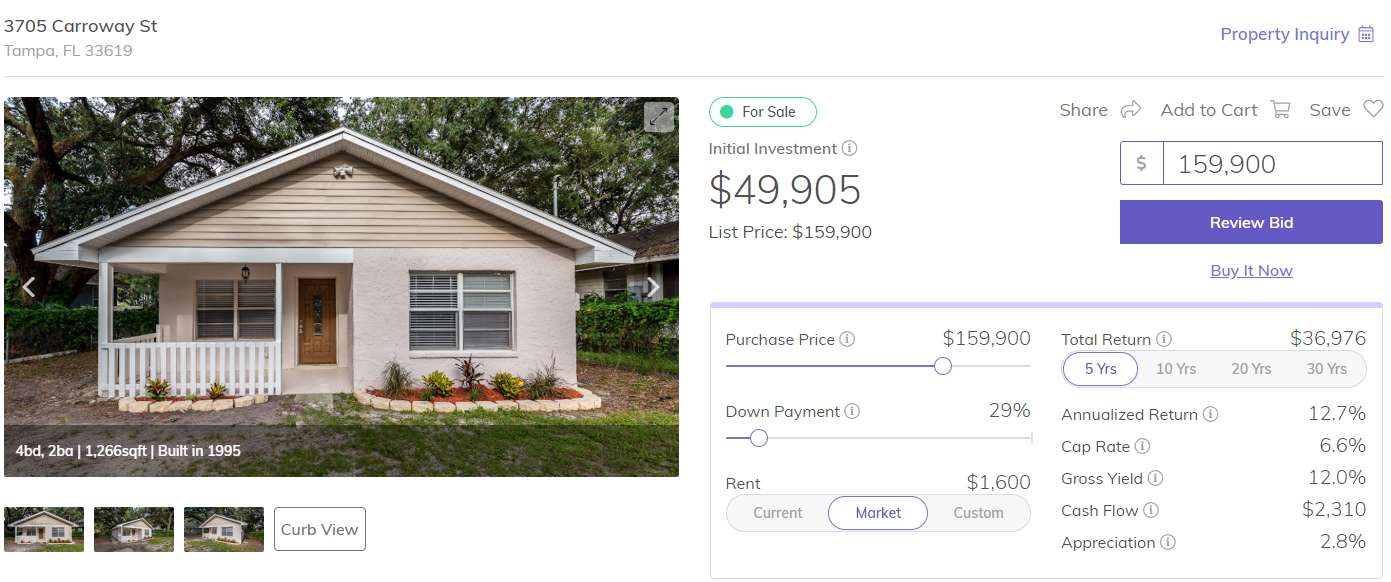

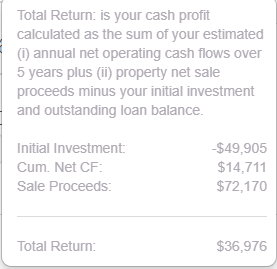

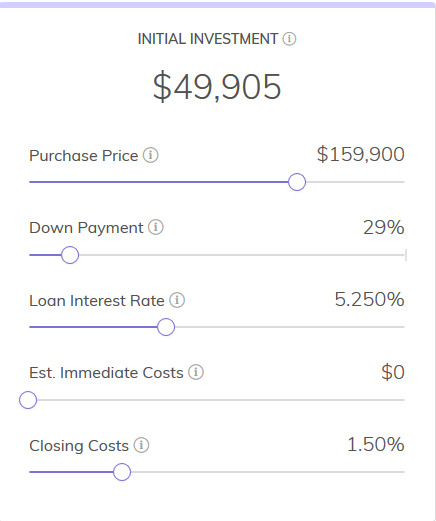

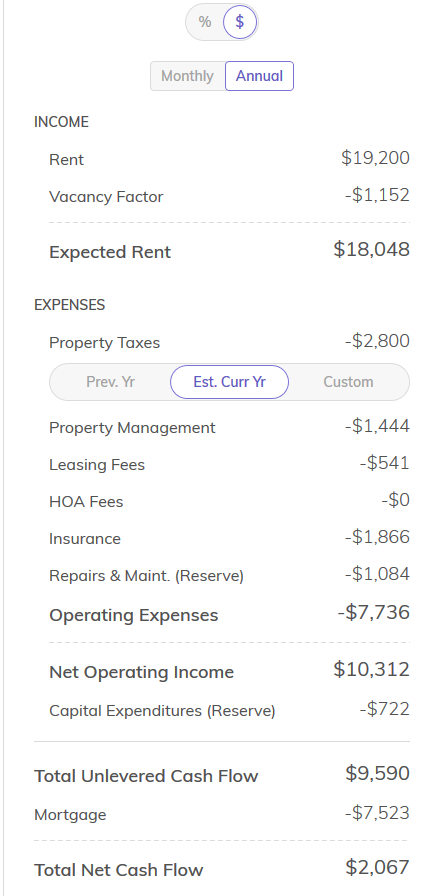

https://www.architecturaldigest.com/reviews/home-improvement/most-climate-resilient-cities Next month, Part 2 - How we select our sub-markets/ neighborhoods After that, Part 3 - How we select our properties Real World Scenario #3 3.1 Buying a investment home out of state vs 3.2 Investing in a 59 unit apartment complex in Jacksonville, FL as a Limited Partner 3.1 Buying a investment home out of state I have numerous examples of people buying investment properties out of state like Texas, Florida, Georgia, North Carolina etc. In fact i have started my real estate journey the same way. I have bought a rental in Raleigh and Atlanta myself with 25% of down payment and got a 30 year investment mortgage. I have picked a property in Roof Stock in Florida which matches 1% rule. This is really good deal in Single Family space. This is 1995 product i am comparing with 1960's Multi-Family. So, I am picking best single family property available as a comparison. 4 bedroom 1995 built property in Tampa When you look at the returns the average cash-flow per month for a 5 year hold is $245. Overall 5 year return is 64%. But you have to go through a recourse-loan process, buying process, selling process, dealing with tenants, toilets, trash and termites with the property management. 3.2 Investing in a 59 unit apartment complex in Jacksonville, FL as a Limited Partner

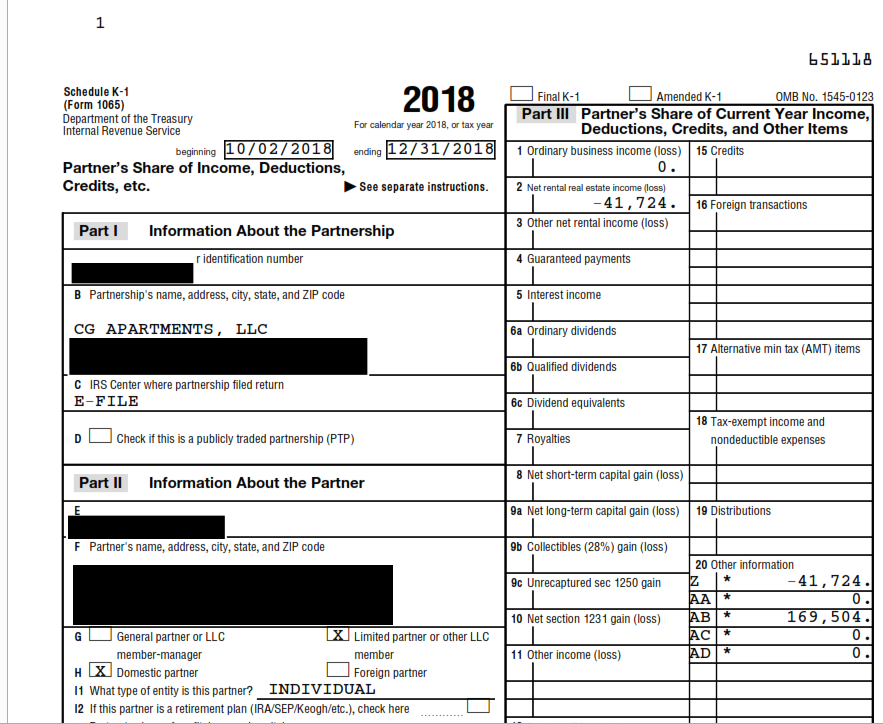

As i said all these are real world examples, i need to pick the property we have bought from Zovest. I cannot pick sample deals here. We bought Casa Grande Apartments in November 2018 for $3.4 Million with 81% 10-year loan from Freddie Mac with 5.01% interest rate. Our down payment was close to 700k and 156k for rehab + working capital. Total raise was 856k. In this scenario if a limited partner invests 50k, he/ she gets 8.25% return with $345 cash flow per month and 18% projected annualized returns at 45k return. This with out dealing with identifying, purchasing, rehabbing, selling the property with a hands-off approach to get passive income. And also since we did our cost segregation study and got 1st year bonus depreciation of 710k for Casa Grande and we passed on the depreciation to our investors. See below real world example of a investor who invested 50k in Casa Grande, the investor has 41k of loss shown in K1 even though they made money! Check with your CPA before taking tax decisions. If you are a qualified real estate professional or have other real estate income you can offset the deprecation. Real World Scenario #2 2.1 Buying a investment home in Bay Area, CA with cash in auction vs 2.2 Buying a 59 unit apartment complex in Jacksonville, FL with leverage 2.1 Buying a investment home in Bay Area, CA with cash in auction I don't want to name, but i have my friend who bought a condo as investment with cash in auction at the court house for 700k in Dublin, CA. And he is the process of buying another home for 850k in San Ramon, CA. His intention was to get some cash-flow and primarily betting on Bay Area home appreciation. When i asked him more questions and details about how much he will make on the condo, he started explaining me that he earns $3000 rent per month. But he didn't take into consideration that he needs to pay property taxes, HOA dues, maintenance and also factor in vacancy/ turn-over costs in case tenant leaves. Lets take in this example he can get $2000 of cash-flow per month. Lets take the San Ramon home example as the numbers are close to the comparison which i am going to do. His intention is to buy a single family home for cash in San Ramon, CA for 850k and rent it out. If we assume it rents for $3500 he can get $2500 of cash-flow per month. From appreciation perspective lets assume the San Ramon Single Family home appreciates to $1.1 Million in 5 years (Which is anyway difficult at this market cycle). So total of $2000 * 60 months = 120k in cash flow + 250k in appreciation = 370k of total profit. 2.2 Buying a 59 unit apartment complex in Jacksonville, FL with Freddie Mac loan As i said all these are real world examples, i need to pick the property we have bought from Zovest. I cannot pick sample deals here. We bought Casa Grande Apartments in November 2018 for $3.4 Million with 81% 10-year loan from Freddie Mac with 5.01% interest rate. Our down payment was close to 700k and 156k for rehab + working capital. Total raise was 856k. In this scenario the returns will be average 12% with cash-flow of average 100k per year and appreciation and principle payments of 500k the total profit is $1 Million after 5 years hold. And also we did our cost seggegration study and got 1st year bonus depreciation of 710k for Casa Grande which is cherry on the top :) This is only possible due to value-addition happening using the 156k rehab budget to renovate all units and raising rents to market. Note 1: Since i live in San Francisco Bay Area, CA and most of my investors are here locally, i will cater this blog towards them. Note 2 and Update: Buying a primary home is an American Dream and I am not denying the fact that it will be more fulfilling and you can create memories in your own home as you raise your family. This is just an illustration and comparison as an investor. In fact now I am reversing my opinion and encouraging to buy primary home (can be a starter home as well). There are 3 types of Single-Family investment scenarios we will consider here:

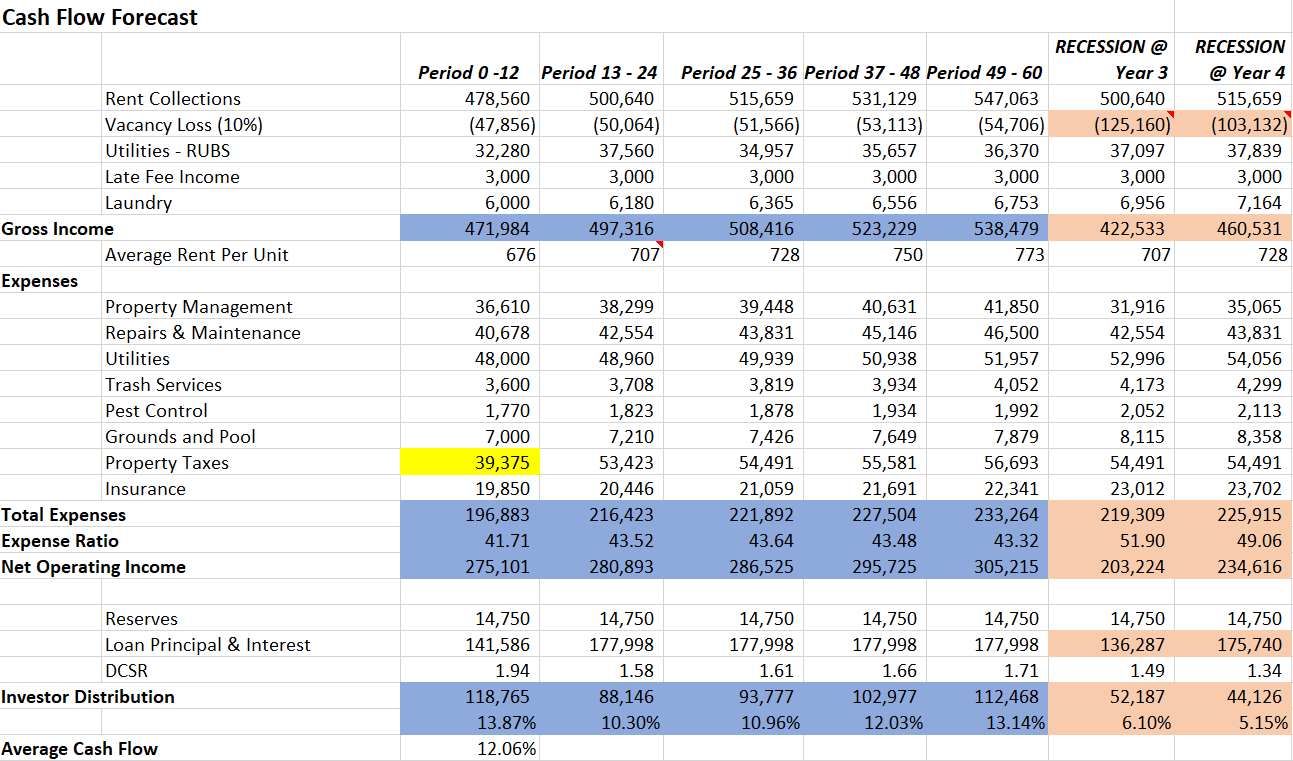

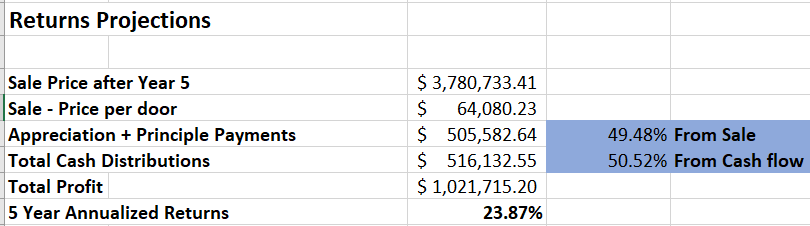

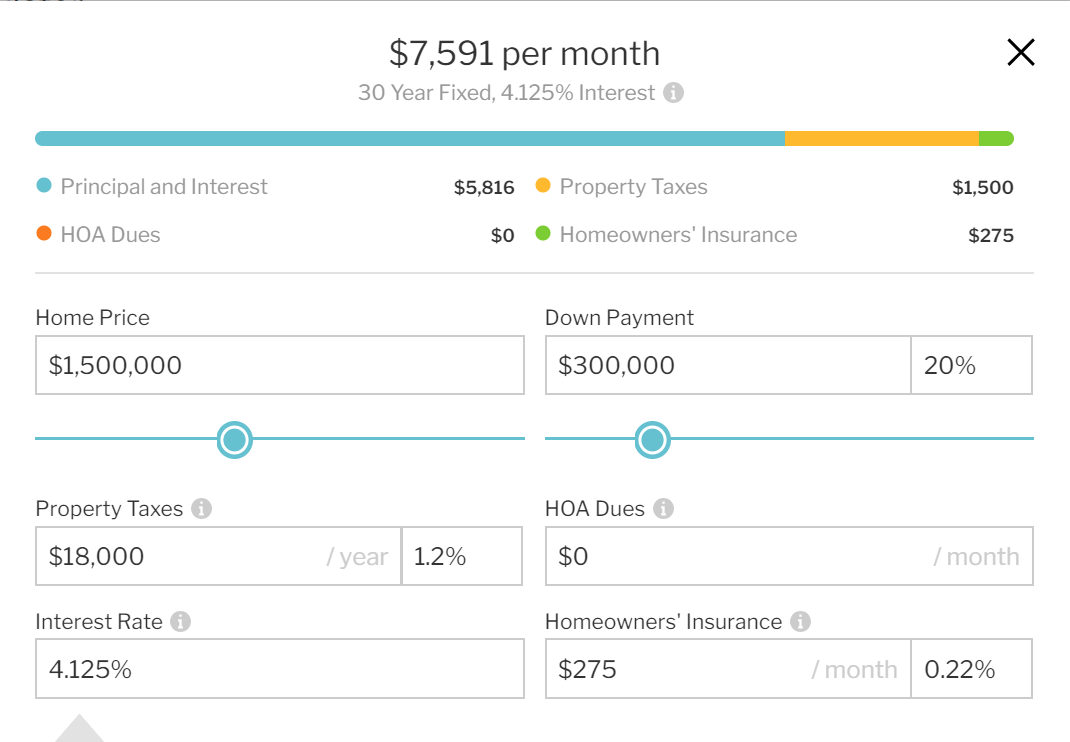

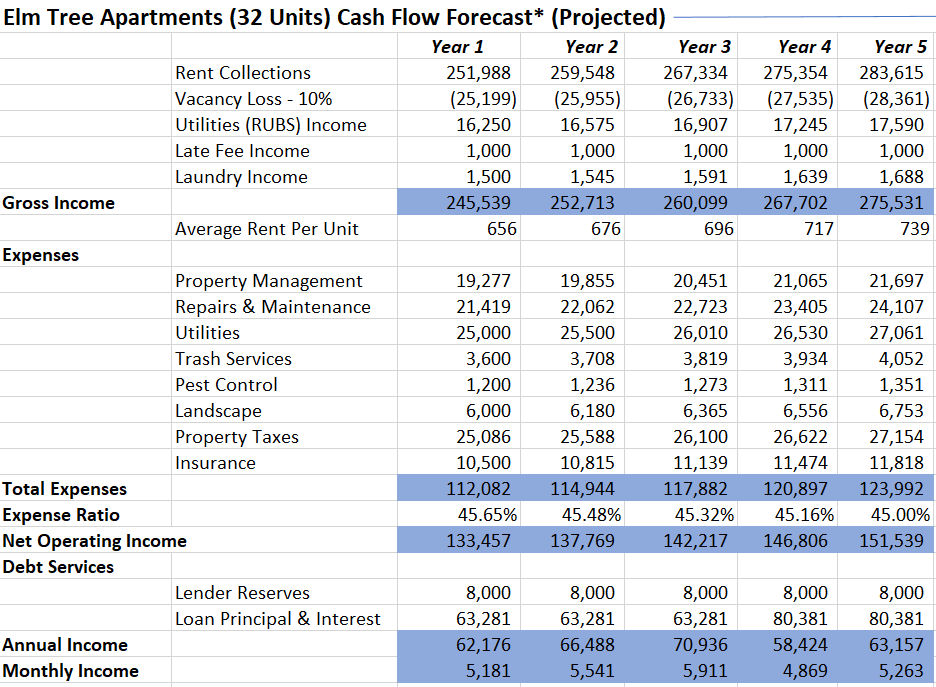

I will like to compare these 3 scenarios with buying Multi-Family Apartment out of state. Real World Scenario #1 1.1 Buying a primary home in Bay Area, CA I did a simple search in Redfin/ Zillow and found that there are more than 4000 homes that are sold in Bay Area, CA between $1.5 Million to $1.75 Million last year. And i personally know lot of my friends and co-workers buying a $1.5 Million Homes. So based on Redfin estimate for a $1.5 Million single family home in Santa Clara County a home owner has to down pay $300k + Closing Costs and pay $7591 as PITI (Principle, Interest, Taxes and Insurance). There are tax benefits for you, but capped at $750k for mortgage and $10k for SALT taxes. I am not a CPA, but tax benefits can be around $1023 per month (Say first 5 years where interest portion will be high). So it will be $6568 per month as payments by the home owner for next 30 years !! Please go to Redfin's resources to know more about how Redfin underwrites and calculates monthly's payments for your single family home. https://www.redfin.com/resources/calculate-debt-to-income-ratio 1.2 Buying a 32 unit apartment complex in Jacksonville, FL We bought a 32 unit complex in Jacksonville FL last year for $1.5 Million, Elm Tree at Hyde Park. Note: Buying an Apartment Complex out of state needs some sophistication and learning. Do not buy without help from someone who already did it like a Mentor. For this property we obtained ~81% loan from Freddie Mac with 20 year term, 30 year amortization, non-recourse, 5.17% interest rate and 3 years of interest only option. With this option we have invested ~$350k including down payment + closing costs + renovation costs of units to raise rents to market. And the projected returns are around $5353 for next 5 years and beyond for rest of the hold of the property. And these returns have tax advantages (again please consult your CPA) because of depreciation we can get for commercial properties. The cash flow is calculated based on a conservative basis after all vacancy factors, repairs and maintenance, Property Taxes, Insurance, Lender Reserves etc. Current average rents for this property is $656 per unit and Market rents are at $717 per unit which we are hitting in Year 4 as per our projections after renovations. Verdict for Scenario #11.1) You have to keep working your day job and pay $6568 for the next 30 years 1.2) You will earn $5353 per month tax free till you hold the property and you can pay off rent/ health insurance/ bills and live anywhere in the world with financial independence. Thanks, Rama Krishna rama@zovest.com Real World Scenario #2 (Coming Soon...) Real World Scenario #3 (Coming Soon...)

What is F.I.R.E. Movement?. FIRE stands for Financial Independence, Retire Early. As per Wikipedia, FIRE Movement, The model is particularly popular among millennials, gaining traction through online communities via information shared in blogs, podcasts, and online discussion forums. Those seeking to attain the goals of FIRE intentionally increase the rate by which they save their income through simple living or generating secondary and passive streams of income. The goal is to save an amount for which the interest generated from investments provides enough money for living expenses in perpetuity. The intention is to allow for retirement from traditional work decades earlier than the standard retirement age. But how can you achieve FIRE? 2 things:

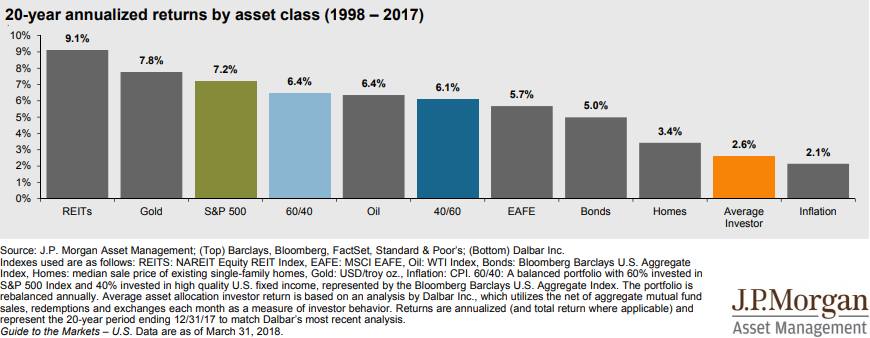

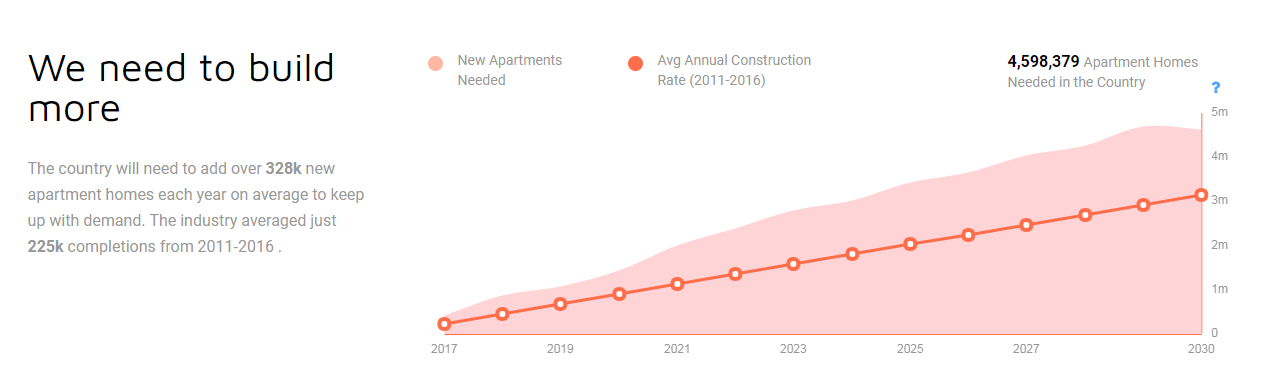

While there are many ways to save the income you are getting through your active job like visualizing all expenses in mint.com or an article from nerdwallet or calling suze orman. For Earning passive income, you can invest in any of the following asset classes and the max returns you get is 9.1% annualized (Also on a Real Estate REIT). Where in Multi-Family Apartment Investments are projected at 18%+ annualized returns in addition to tax benefits using depreciation (including accelerated and bonus depreciation). We will have to build 4.6 million new apartments by 2030 just to keep up with the strong demand-but Apartments got a long history of out-performance in returns with other commercial real estate classes as well. Email me at rama@zovest.com for more information. Who is a Zovestor? Investor who knows that happiness is passive income and Financial Freedom!

I am one of those who has worked for a number of different employers as a full-time employee with funded 401K accounts. Often, whenever I changed jobs I would automatically rollover my former 401K account at the previous job into the new employer’s 401K, plus, there have even been a couple of times that I had left my funds in the former account where it was dormant for years, sometimes as cash, and sometimes as low yielding bonds over which I had absolutely no control. For a while I had thought that I was the only one who was this passive about my funds and investments, then I discovered that I wasn’t! In fact, this tendency is so widespread that, last year alone, almost $9 billion were abandoned or neglected in old 401K’s and retirement plans of past employers from previous jobs. Not only this, but it was also apparent these previous employees, who actually own these funds have very little control over the money. Their investment options are quite limited, even when it comes to stocks and bonds, and the fees are mostly exorbitant. Fast forward to a few months back, I discovered Self-Directed IRA’s that afford you the opportunity to roll over your previous 401K funds and to grant you complete control over your investment choices which are inclusive of varied investment opportunities like Real Estate, Precious metals, as well as Crypto-Currencies. I found the Real Estate aspect of investing quite fascinating and I started doing my own personal research on it. What I found out was that there are two different types of Self-Directed IRA’s. The first kind is one that comes with an account manager or custodian assigned to manage the account for you and to conduct all necessary transactions on your behalf. In contrast, the second category is one that grants you autonomy, with complete checkbook control over your account and overall your transactions, with the only condition being that you refrain from any nefarious or otherwise illegal or suspicious transactions that may make you run afoul of the law. These Self-Directed IRA’s appear quite appealing but their major disadvantage is that they charge very high and exorbitant fees. I have researched them over and again and interviewed scores of their providers, but they are all mostly similar in operation, charging numerous fees on each transaction and for each property you own or operate, making them quite expensive. Fortunately, there are a couple of exceptions to this unpleasantness, and boy was I glad to have found them. My intensive search helped me to discover Solo 401K and QRP (Qualified Retirement Plan), and very fortunately so. I have compared several providers to both Solo 401K and QRP in my quest to find the best outfit to work with, but none measured up to both, especially to Solo 401K. Solo 401K gives you complete checkbook control to invest in Real Estate, especially in Apartments, which can be a source of constant mail-box income for you. Learn about Self-Directed IRA's here Learn about Solo 401k's here Learn about QRP here We have researched many providers of Self-Directed IRA’s alongside Solo 401K and QRP providers, and as our final verdict, we are definitely recommending Solo401K.com. In fact, we have been recommending them to many of our existing partners and investors and all of them have been satisfied with their services. Ensure you contact Rachel Nabers <rachel@solo401k.com> for all your inquiries and refer our name to get top-notch, 5-star rated service. Nabers group are pioneers with the best service and the lowest cost! We did a webinar on "Investing in Apartments using Solo 401k" with Rachel Nabers. Please see Recording and, Slide Deck:

|

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed