|

Note 1: Since i live in San Francisco Bay Area, CA and most of my investors are here locally, i will cater this blog towards them. Note 2 and Update: Buying a primary home is an American Dream and I am not denying the fact that it will be more fulfilling and you can create memories in your own home as you raise your family. This is just an illustration and comparison as an investor. In fact now I am reversing my opinion and encouraging to buy primary home (can be a starter home as well). There are 3 types of Single-Family investment scenarios we will consider here:

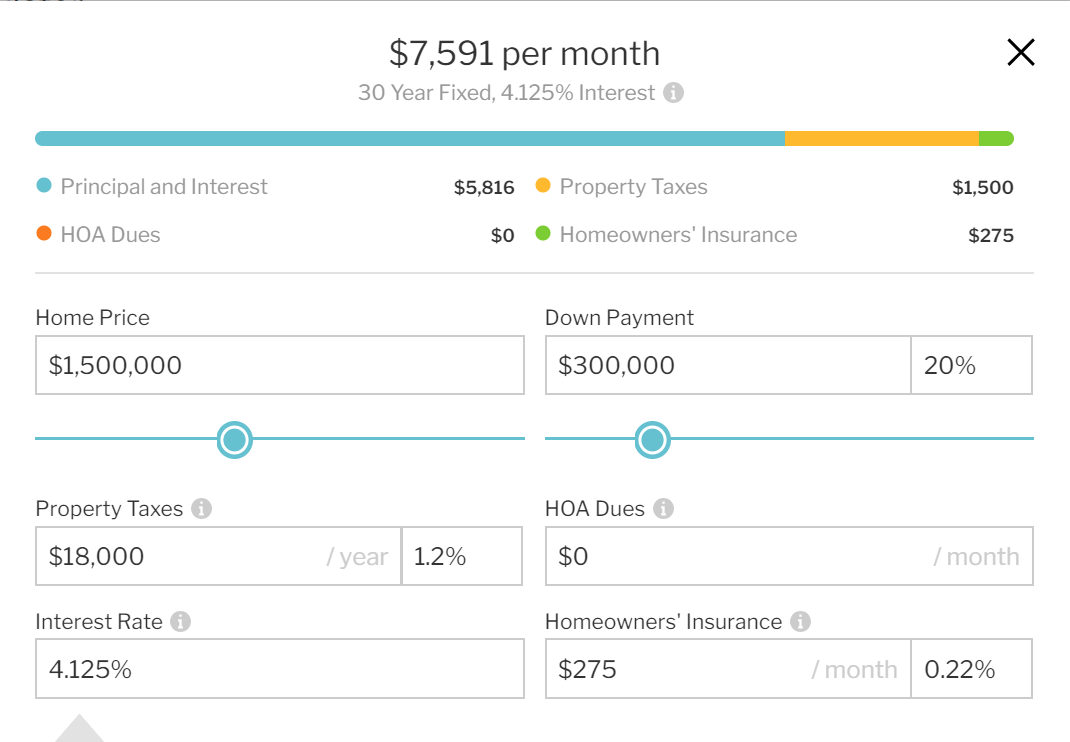

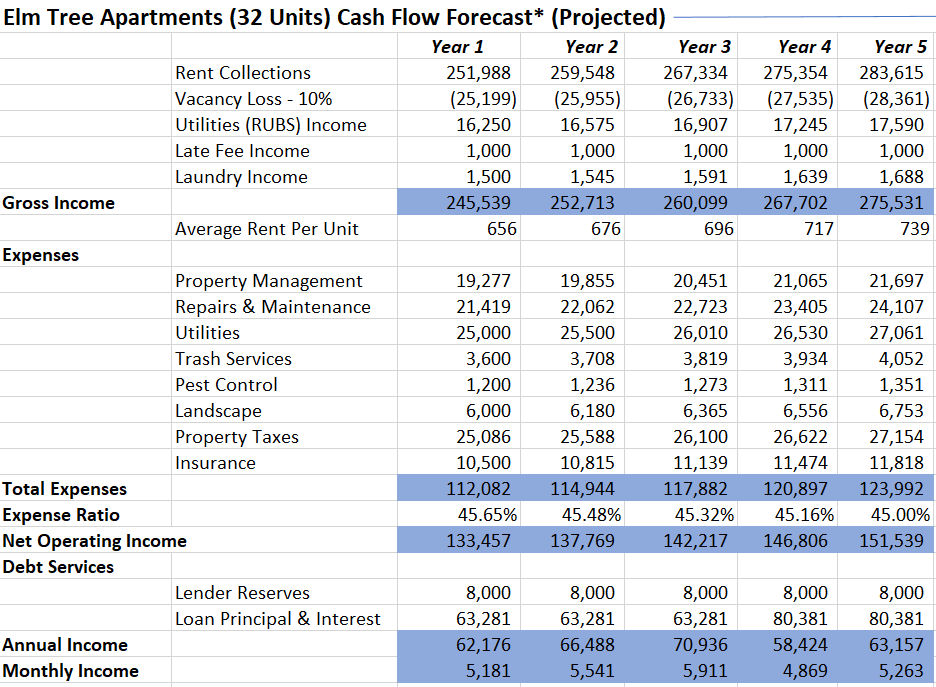

I will like to compare these 3 scenarios with buying Multi-Family Apartment out of state. Real World Scenario #1 1.1 Buying a primary home in Bay Area, CA I did a simple search in Redfin/ Zillow and found that there are more than 4000 homes that are sold in Bay Area, CA between $1.5 Million to $1.75 Million last year. And i personally know lot of my friends and co-workers buying a $1.5 Million Homes. So based on Redfin estimate for a $1.5 Million single family home in Santa Clara County a home owner has to down pay $300k + Closing Costs and pay $7591 as PITI (Principle, Interest, Taxes and Insurance). There are tax benefits for you, but capped at $750k for mortgage and $10k for SALT taxes. I am not a CPA, but tax benefits can be around $1023 per month (Say first 5 years where interest portion will be high). So it will be $6568 per month as payments by the home owner for next 30 years !! Please go to Redfin's resources to know more about how Redfin underwrites and calculates monthly's payments for your single family home. https://www.redfin.com/resources/calculate-debt-to-income-ratio 1.2 Buying a 32 unit apartment complex in Jacksonville, FL We bought a 32 unit complex in Jacksonville FL last year for $1.5 Million, Elm Tree at Hyde Park. Note: Buying an Apartment Complex out of state needs some sophistication and learning. Do not buy without help from someone who already did it like a Mentor. For this property we obtained ~81% loan from Freddie Mac with 20 year term, 30 year amortization, non-recourse, 5.17% interest rate and 3 years of interest only option. With this option we have invested ~$350k including down payment + closing costs + renovation costs of units to raise rents to market. And the projected returns are around $5353 for next 5 years and beyond for rest of the hold of the property. And these returns have tax advantages (again please consult your CPA) because of depreciation we can get for commercial properties. The cash flow is calculated based on a conservative basis after all vacancy factors, repairs and maintenance, Property Taxes, Insurance, Lender Reserves etc. Current average rents for this property is $656 per unit and Market rents are at $717 per unit which we are hitting in Year 4 as per our projections after renovations. Verdict for Scenario #11.1) You have to keep working your day job and pay $6568 for the next 30 years 1.2) You will earn $5353 per month tax free till you hold the property and you can pay off rent/ health insurance/ bills and live anywhere in the world with financial independence. Real World Scenario #2 (Coming Soon...) Real World Scenario #3 (Coming Soon...)

1 Comment

|

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed