|

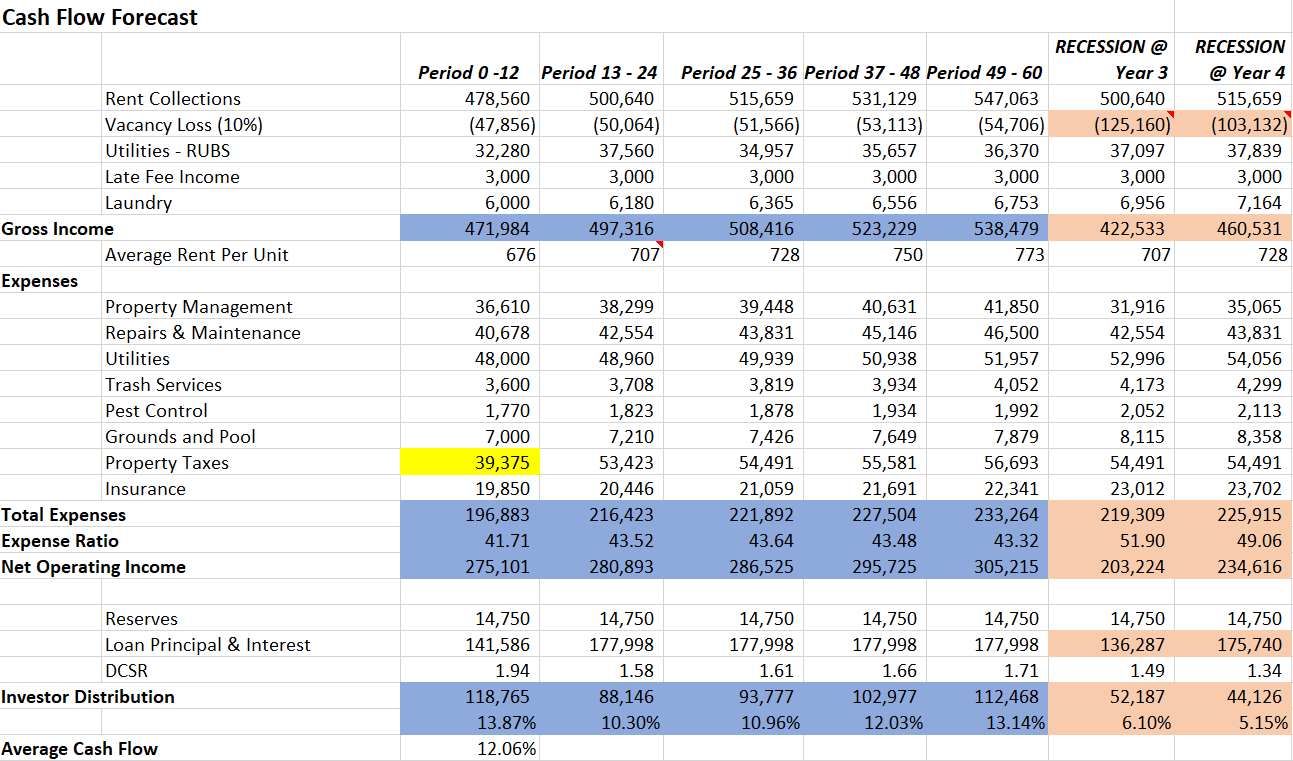

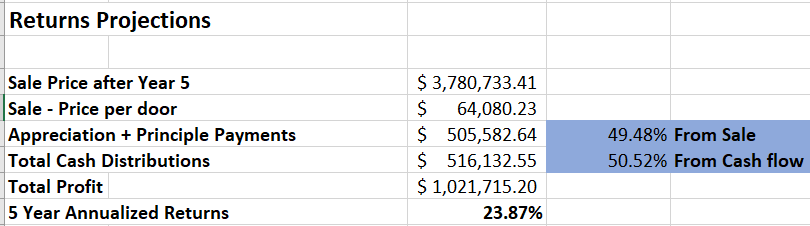

Real World Scenario #2 2.1 Buying a investment home in Bay Area, CA with cash in auction vs 2.2 Buying a 59 unit apartment complex in Jacksonville, FL with leverage 2.1 Buying a investment home in Bay Area, CA with cash in auction I don't want to name, but i have my friend who bought a condo as investment with cash in auction at the court house for 700k in Dublin, CA. And he is the process of buying another home for 850k in San Ramon, CA. His intention was to get some cash-flow and primarily betting on Bay Area home appreciation. When i asked him more questions and details about how much he will make on the condo, he started explaining me that he earns $3000 rent per month. But he didn't take into consideration that he needs to pay property taxes, HOA dues, maintenance and also factor in vacancy/ turn-over costs in case tenant leaves. Lets take in this example he can get $2000 of cash-flow per month. Lets take the San Ramon home example as the numbers are close to the comparison which i am going to do. His intention is to buy a single family home for cash in San Ramon, CA for 850k and rent it out. If we assume it rents for $3500 he can get $2500 of cash-flow per month. From appreciation perspective lets assume the San Ramon Single Family home appreciates to $1.1 Million in 5 years (Which is anyway difficult at this market cycle). So total of $2000 * 60 months = 120k in cash flow + 250k in appreciation = 370k of total profit. 2.2 Buying a 59 unit apartment complex in Jacksonville, FL with Freddie Mac loan As i said all these are real world examples, i need to pick the property we have bought from Zovest. I cannot pick sample deals here. We bought Casa Grande Apartments in November 2018 for $3.4 Million with 81% 10-year loan from Freddie Mac with 5.01% interest rate. Our down payment was close to 700k and 156k for rehab + working capital. Total raise was 856k. In this scenario the returns will be average 12% with cash-flow of average 100k per year and appreciation and principle payments of 500k the total profit is $1 Million after 5 years hold. And also we did our cost seggegration study and got 1st year bonus depreciation of 710k for Casa Grande which is cherry on the top :) This is only possible due to value-addition happening using the 156k rehab budget to renovate all units and raising rents to market.

0 Comments

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed