|

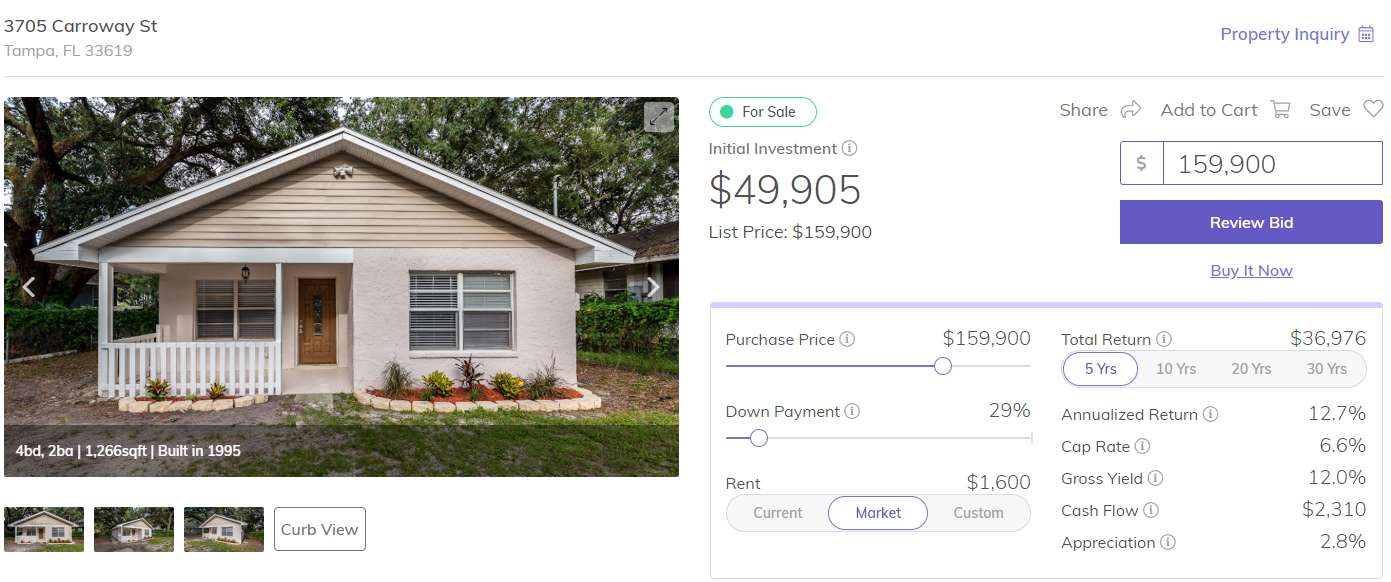

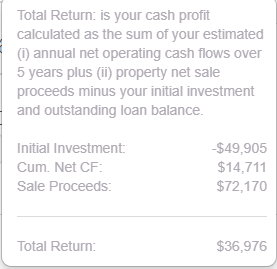

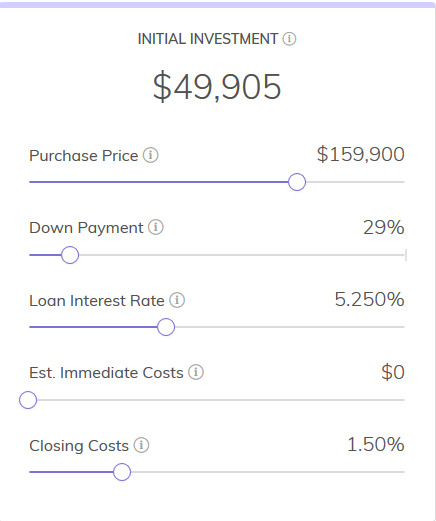

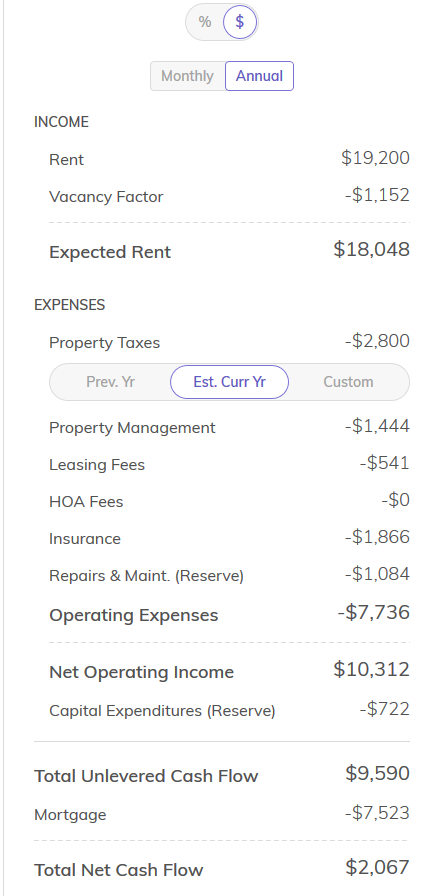

Real World Scenario #3 3.1 Buying a investment home out of state vs 3.2 Investing in a 59 unit apartment complex in Jacksonville, FL as a Limited Partner 3.1 Buying a investment home out of state I have numerous examples of people buying investment properties out of state like Texas, Florida, Georgia, North Carolina etc. In fact i have started my real estate journey the same way. I have bought a rental in Raleigh and Atlanta myself with 25% of down payment and got a 30 year investment mortgage. I have picked a property in Roof Stock in Florida which matches 1% rule. This is really good deal in Single Family space. This is 1995 product i am comparing with 1960's Multi-Family. So, I am picking best single family property available as a comparison. 4 bedroom 1995 built property in Tampa When you look at the returns the average cash-flow per month for a 5 year hold is $245. Overall 5 year return is 64%. But you have to go through a recourse-loan process, buying process, selling process, dealing with tenants, toilets, trash and termites with the property management. 3.2 Investing in a 59 unit apartment complex in Jacksonville, FL as a Limited Partner

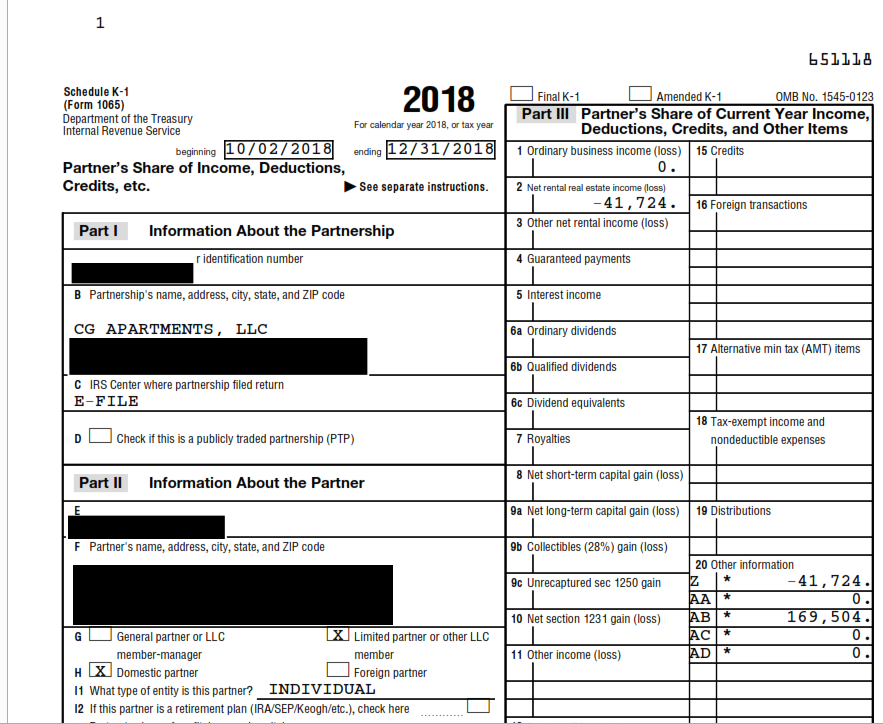

As i said all these are real world examples, i need to pick the property we have bought from Zovest. I cannot pick sample deals here. We bought Casa Grande Apartments in November 2018 for $3.4 Million with 81% 10-year loan from Freddie Mac with 5.01% interest rate. Our down payment was close to 700k and 156k for rehab + working capital. Total raise was 856k. In this scenario if a limited partner invests 50k, he/ she gets 8.25% return with $345 cash flow per month and 18% projected annualized returns at 45k return. This with out dealing with identifying, purchasing, rehabbing, selling the property with a hands-off approach to get passive income. And also since we did our cost segregation study and got 1st year bonus depreciation of 710k for Casa Grande and we passed on the depreciation to our investors. See below real world example of a investor who invested 50k in Casa Grande, the investor has 41k of loss shown in K1 even though they made money! Check with your CPA before taking tax decisions. If you are a qualified real estate professional or have other real estate income you can offset the deprecation.

3 Comments

4/16/2019 06:04:29 am

Extraordinary designation focuses in here. Keep up the great work!

Reply

5/31/2022 09:03:39 pm

Nice post so far. Thanks for sharing your amazing blog.

Reply

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed