|

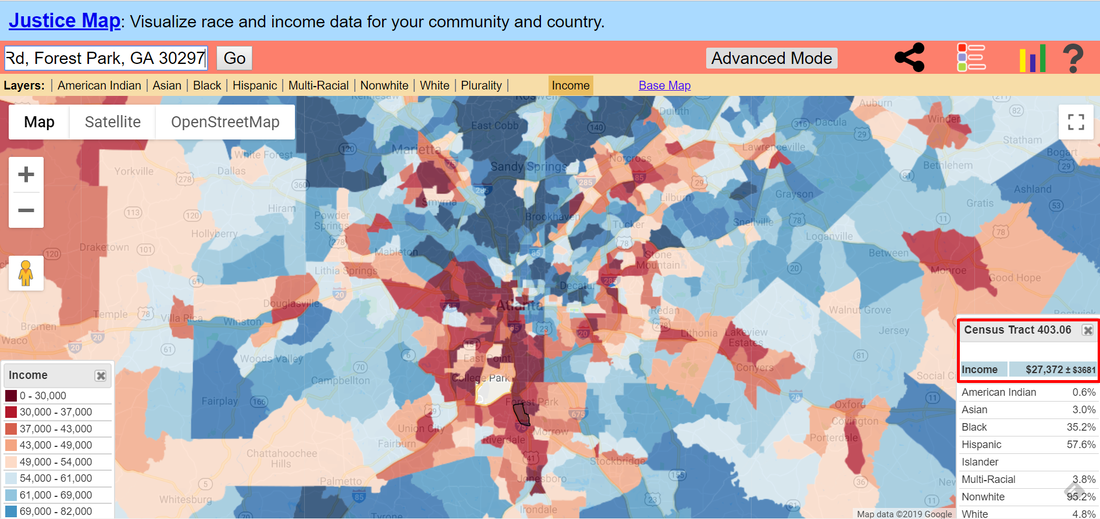

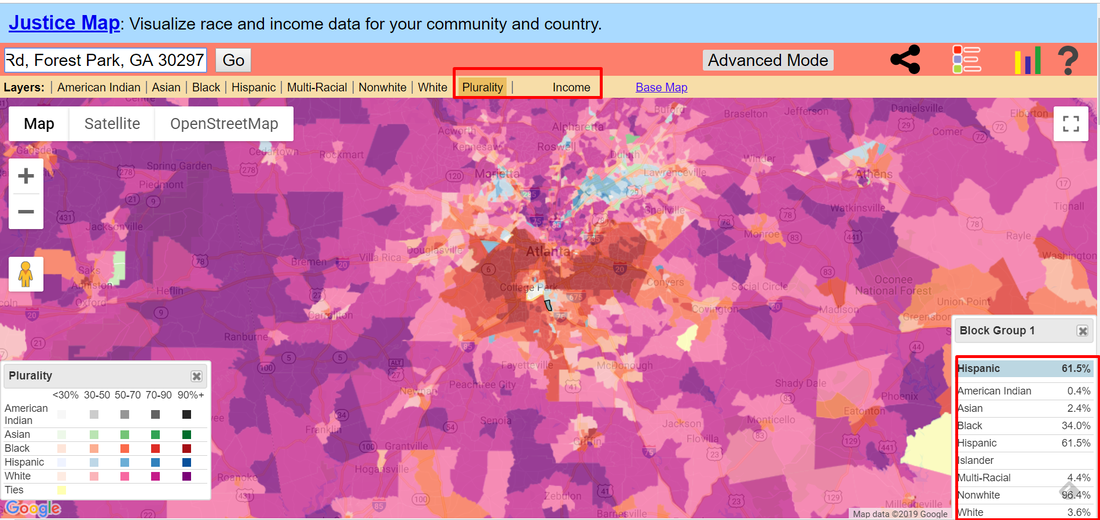

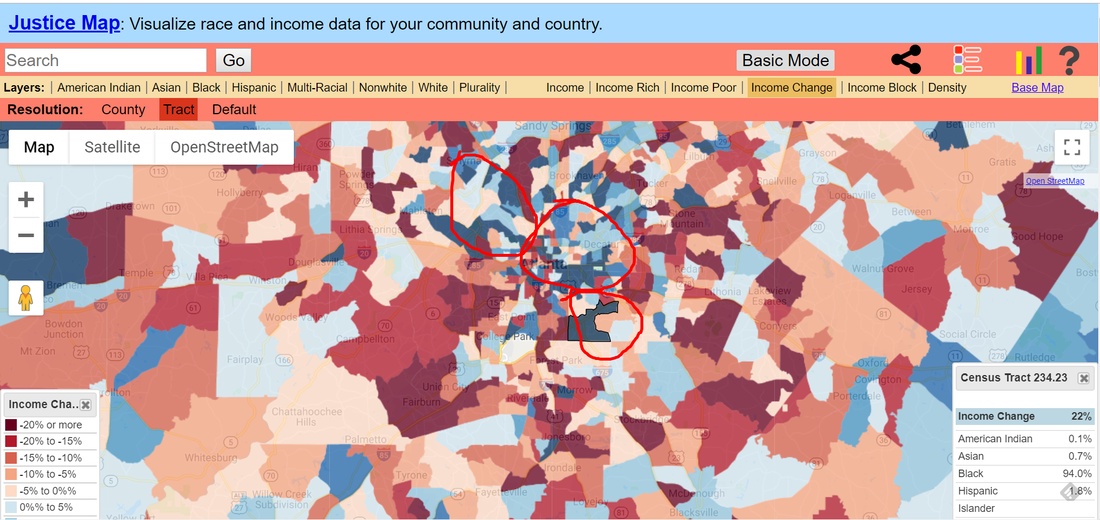

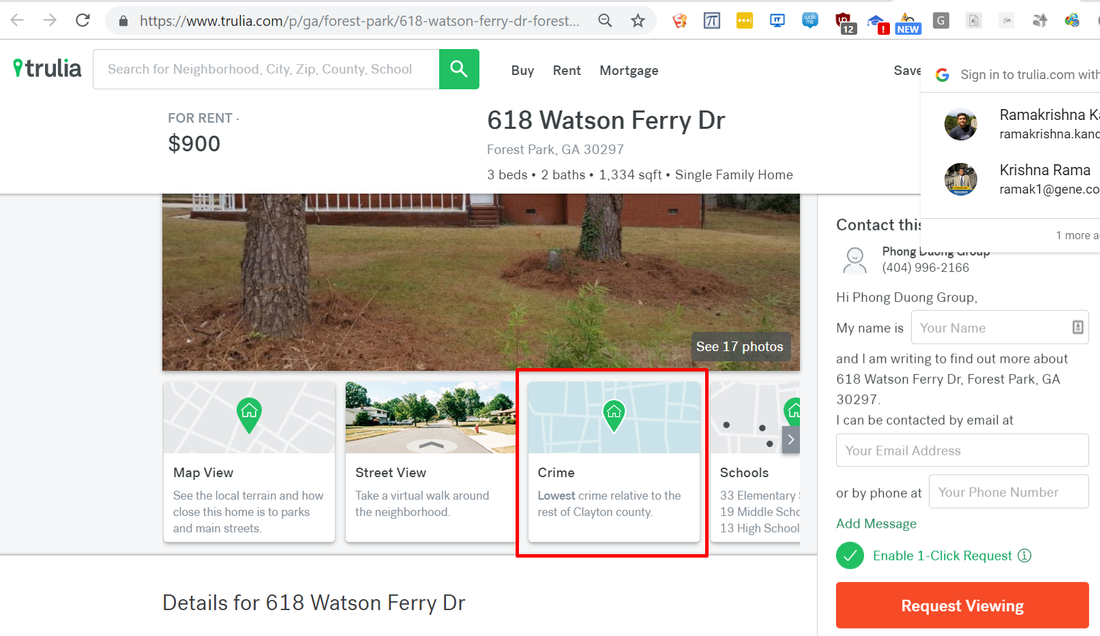

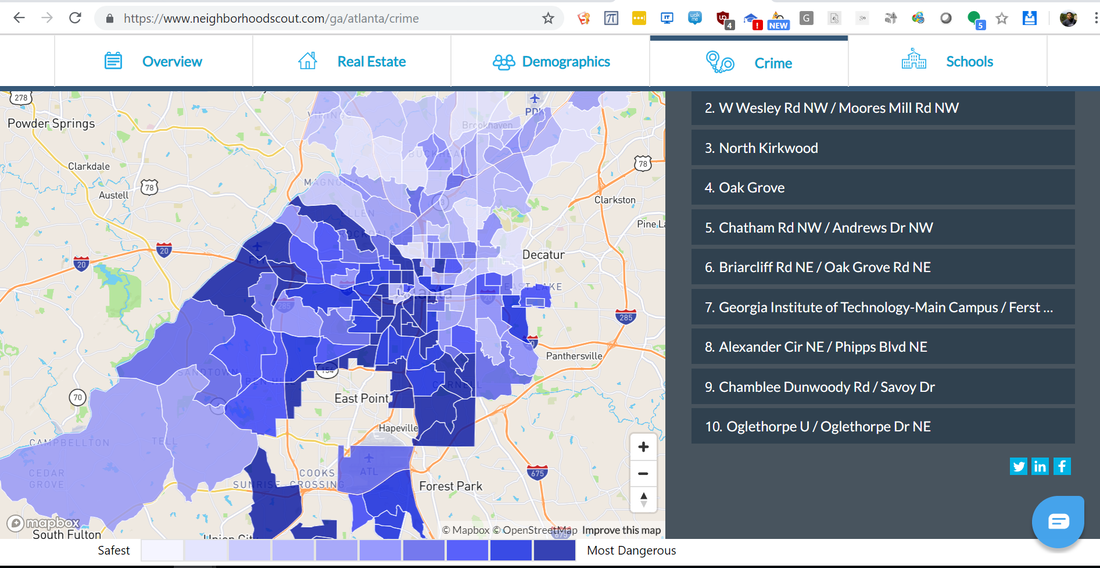

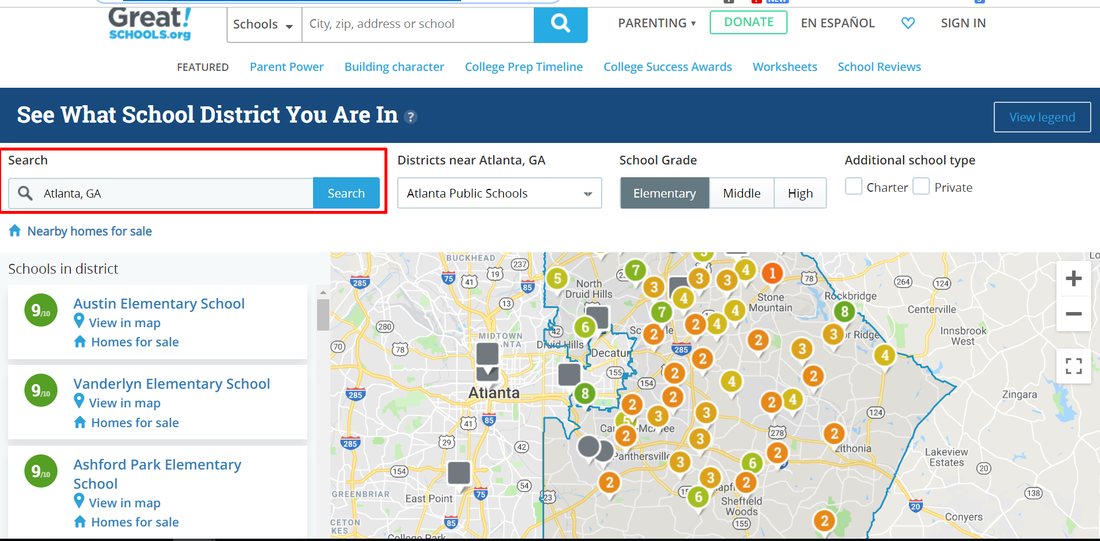

Part 2 - How we select our Sub-Markets/ Neighborhoods Last month we saw how we select our markets. Which is really important to narrow down an MSA (Metropolitan Statistical Area). But it's equally important to select right Sub-Markets/ neighborhoods/ census block. Its extremely difficult to be perfect but anyone who is buying large properties has to at least know the facts before selecting. So one can underwrite it correctly. Note: The information is provided only for education purpose only. Don't make any purchasing/ investment decisions based on the blog or any content in this website. Please consult professionals in every area before proceeding. 1) Median Income 2) Demographic Mix 3) Path of progress 4) Crime 5) Schools 6) Public Transportation 7) Close to Retail 8) Percentage of Renters/ Owners 9) Single-Family home prices nearby 10) Vacancy rates 1) Median Income Median income in the 5-mile, 3-mile, 1- mile and census block level is really important to identify good sub-markets. General rule of thumb is to avoid sub-markets and blocks which are less than 45k Median Income. Easiest way to find median income is from census data aggregators like City-Data.com or JusticeMap.org. I particularly like JusticeMap.org because you can give address and it gives you Demographics and Median Income of exact census block. Below you can see Median Income of an Apartment Complex in Atlanta by providing address. And also you can see what the good and bad parts of Atlanta. Between, you can still buy in blocks where median income is low, but make sure you underwrite properly and also assume that you have lot of delinquencies, bad debt, turnover etc. 2) Demographic Mix Also it's important to have good mix of Demographics in that block/ sub-markets. See demographics mix of a property in Atlanta using JusticeMap. 3) Path of progress There are several ways to identify if the area is in path of progress like City is doing any developments in that area. If private money coming into that area. If it's part of Opportunity Zone. If it's in gentrifying area. One of the easiest way to find if the median income is increasing. Again using JusticeMap, please go to Advanced mode and select Income change and you can identify the blocks where income is going up. 4. Crime Crime is really important factor when you consider buying a property in a sub-market or neighborhood. This will have direct impact on your bottom line and how you can operate a property. I use Trulia to check the address and see if its Lowest, Moderate or Highest crime area. Or Neighborhood Scout map to identify if that sub-market is Safest to Most Dangerous. https://www.neighborhoodscout.com/ga/atlanta/crime 5) Schools Good schools is one factor where you can pay premium to the apartment because of several factors like families live in those Apartments and they stay long term. Crime is also relatively low near good schools. Great Schools website has really good feature where you can key in the address and it gives you schools for that property. https://www.greatschools.org/school-district-boundaries-map/ 6) Public Transportation

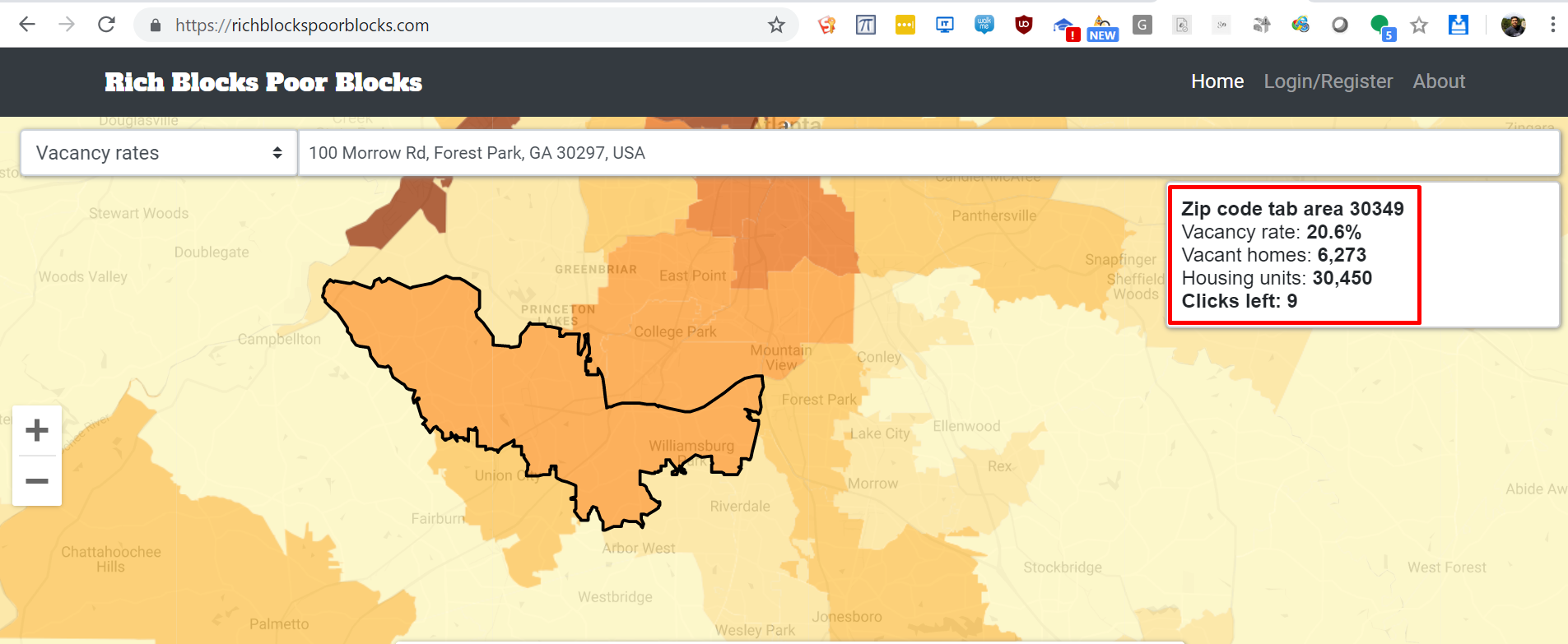

If the property is near public transportation like Metro, Subway etc the rentability of the Apartment will be higher. Because of more urbanization, public transportation access will be a major plus. 7) Close to Retail Close to retail, restaurants, office space is a really good as people are preferring live, work, play type of environment. Some investors prefer the Starbucks rule where the proximity of the property to a Starbucks will give the confidence that this is good area as Starbucks itself does several proprietary analysis to launch a new location. 8) Percentage of Renters/ Owners You need to know what is the percentages of renters vs owners in that sub-market or block. If there are 90% of renters might not be a good idea. As there are so many Apartments/ Rental units to choose and also there is no pride of ownership in that area. So a good mix of renters and owners is better. US average is 36% renters and 64% home owners. Note: Current Home ownership is lowest in the history. 9) Single-Family home prices nearby Average single family home prices nearby the property is also good indication if you want to buy that property or not. If you are buying an Apartment at 100k a door and if average home prices in that area is 150k, then it's not a good deal. For a 100k a door, the median home prices better to be around 350k or more. 10) Vacancy rates Rental vacancy rates from census data or USPS data is really important factor to consider buying a property as you need to underwrite it appropriately for that block or sub-market. Several paid tools can give you the data and one of the tool is Rich Blocks Poor Blocks. https://richblockspoorblocks.com/

2 Comments

|

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed