|

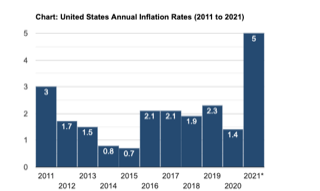

If you have been paying attention to the asset markets in the last 12 months, you would agree that we have noticed some some significant but unexpected changes. While everyone predicted markets to crash, stock prices and real estate have boomed, to the contrary. Fast-rising housing costs have helped to push inflation to a 13-year high. But the way that government statisticians track the price of consumer goods may be missing just how explosive home-price growth has been in recent months.

Altogether, the rise in housing prices accounted for over a quarter of the overall increase in inflation in May, a reflection of how heavily government economists weight this spending category. Consumer prices jumped 5% just in May of 2021 . They accelerated at their fastest pace in nearly 13 years as inflation pressures continued to build in the U.S. economy. Used cars and truck prices continued their climb higher, rising 7.3% in the month of May'21 and 29.7% for the past 12 months. The new vehicles index increased 1.6%, its biggest-single month gain since October 2009 and was up 3.3% for the 12-month period, the highest move since November 2011. Although the prices have been increasing, the wages have not increased much. As the country recovers from pandemic, rising inflation could attract federal reserve to raise the interest rates in near future. All in all my question is , how safe is holding cash if the money continues to loose value at this rate? Real Estate is one asset class where inflation works in our favor, with inflation, rents increase as well as property valuations, effectively hedging the risk of capital to a significant extent.

0 Comments

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed