Part 1 - How we select our States/ Markets

These are the following Attributes we look when selecting states/ cities/ MSA's

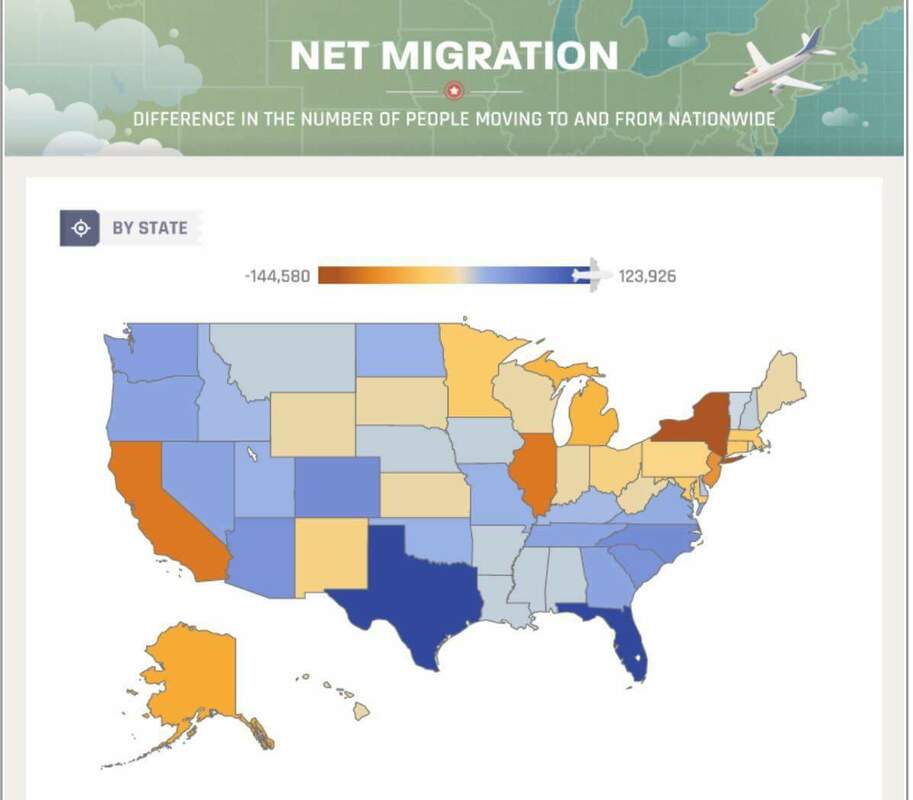

Note: The information is provided only for education purpose only. Don't make any purchasing/ investment decisions based on the blog or any content in this website. Please consult professionals in every area before proceeding. 1) Above average Population Growth 2) Above average Job Growth 3) No income tax states 4) Low property or overall tax states 5) Landlord Friendly States 6) High Average Home Price/ Average Annual Rent ratio 7) Decreasing Trend in overall crime in the market/ state 8) City/ County/ State doing any developments to improve infrastructure 9) Minimum population 250k (Preferably 500k or above) 10) Safety of the City. Community/ No severe weather/ natural calamities/ Financial Safety. 1) Above average Population Growth The population growth of the Market (City or MSA) should be above the national average. Census Bureau Reveals Fastest-Growing Large Cities where you can identify top cities. https://www.census.gov/newsroom/press-releases/2018/estimates-cities.html Also you can see net migration happening between states:

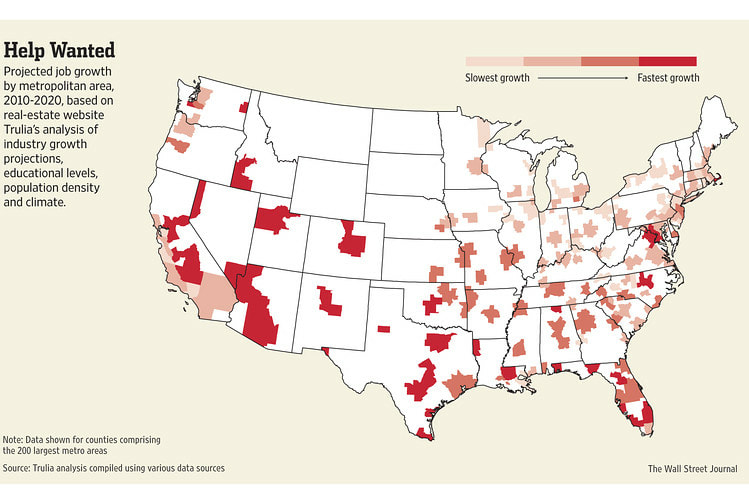

2) Above average Job Growth

Job growth actually is in conjunction with population growth. If more jobs are coming more population will move and vice-versa. Find below WSJ's projection of job growth from 2010 to 2020.

3) No income tax states

Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee have no income tax. Lot of people moving into some of these no income tax states as they can save on taxes. But need to make sure you pick the right states where population and jobs are actually growing. Just no income tax doesn't mean its a good state/ market to invest. 4) Low property or overall tax states Low property taxes can be better for an Apartment Operator where the expenses are lower. But its really important to know that property taxes as home owner might be different than a landlord. You need to find it out from tax assessor before underwriting a deal. Find all the states from lowest to highest property taxes: Source: https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585/ As per Wallet Hub, "Tax season can be stressful for the millions of Americans who owe money to Uncle Sam. Every year, the average U.S. household pays nearly $11,000 in federal income taxes. And while we’re all faced with that same obligation, there is significant difference when it comes to state and local taxes. Taxpayers in the most tax-expensive states, for instance, pay two times more than those in the cheapest states. Surprisingly, though, low income taxes don’t always mean low taxes as a whole. For example, while the state of Washington’s citizens don’t pay income tax, they still end up spending over 8% of their annual income on sales and excise taxes. Texas residents also don’t pay income tax, but spend 1.74% of their income on real estate taxes, one of the highest rates in the country. Compare these to California, where residents owe almost 5% of their income in sales and excise taxes, and just 0.75% in real estate tax." Source: https://wallethub.com/edu/best-worst-states-to-be-a-taxpayer/2416 Property Taxes by State

Source: WalletHub

States with the Highest & Lowest Overall Tax Rates

Source: WalletHub

5) Landlord Friendly States

Operating in a landlord friendly states is extremely important factor when buying Apartments. As a landlord you need to make sure you know the laws of eviction, rent control, essential services etc. Investing without knowing these will be most expensive mistake. See interactive US map where you can hover and see if a state is landlord-friendly or renter-friendly.

6) High Average Home Price/ Average Annual Rent ratio

As per Rentberry: Price to Rent Ratio = Average Property Price/Average Annual Rent Example: Philadelphia, PA

Price to Rent Ratio = 18 The price to rent ratio is classified into three ranges: 15 and below: If the price to rent ratio is 15 or below, this means that from a financial point in your housing market it is better to buy a home rather than rent one. Property prices are cheap relative to rents. 16-20: In a market where the price to rent ratio ranges between 16 and 20, it is usually better to rent rather than to buy real estate. Property prices are rather high compared to rental rates. 21 and above: Finally, if you are located in a market where the price to rent ratio exceeds 21, you should definitely rent a property and not buy a home. Property prices are too expensive compared to rents, so renting is the more sound financial decision. So you have to identify markets which have higher price/ rent ratio: https://rentberry.com/blog/highest-prices-markets-us 7) Decreasing Trend in overall crime in the market/ state Make sure the overall crime index in the market/ state is in downward trend. This is really important to see if the market/ state is going in right direction. City-Data can give the crime index of each market from past 10 to 20 years. You can see if the trend is decreasing: http://www.city-data.com/city/Dallas-Texas.html 8) City/ County/ State doing any developments to improve infrastructure Inquire if the city/ county/ state are doing any massive developments or infrastructure improvements so it will be beneficial for your investments. 9) Minimum population 250k (Preferably 500k or above) Try to buy in larger MSA's as it will be easier to trade/ sell later. If population is say 5000 it might be difficult as there are no investors interested in that market. 10) Safety of the City. Community/ No severe weather/ natural calamities/ Financial Safety See if that market doesn't have severe weather or numerous natural calamities in the past which effect your operations, insurance requirements and returns to investors.

Source: WalletHub

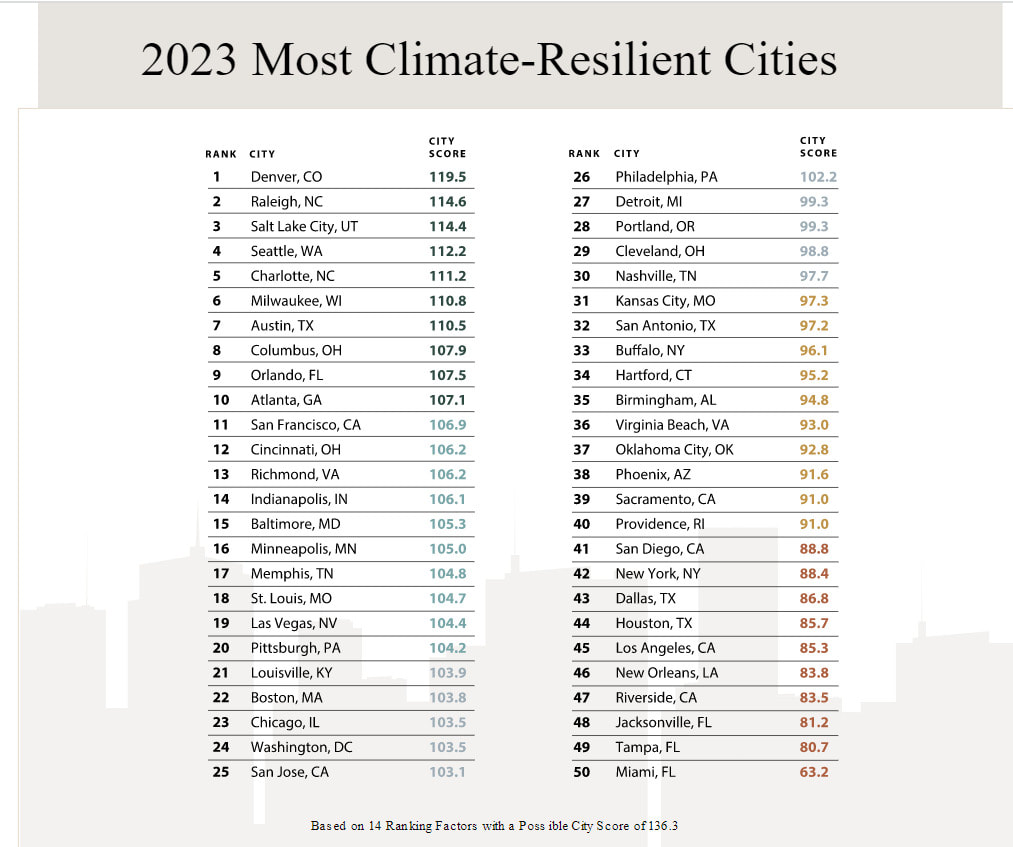

Climate Resilient Cities (No severe weather/ natural calamities)

"Unfortunately, there’s nowhere to hide from the effects of climate change. Every region in the United States has experienced rising temperatures, extreme weather patterns, and greater damage from natural disasters. Most experts predict that many areas will be unlivable by 2050, which is well within the scope of a 30-year mortgage. While some U.S. cities are better prepared to weather climate change’s effects, other locations are more likely to suffer based on geography and a lack of infrastructure and preparation." Source: https://www.architecturaldigest.com/reviews/home-improvement/most-climate-resilient-cities

Source:

https://www.architecturaldigest.com/reviews/home-improvement/most-climate-resilient-cities Next month, Part 2 - How we select our sub-markets/ neighborhoods After that, Part 3 - How we select our properties

0 Comments

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed