|

Opportunity zones – What are they?

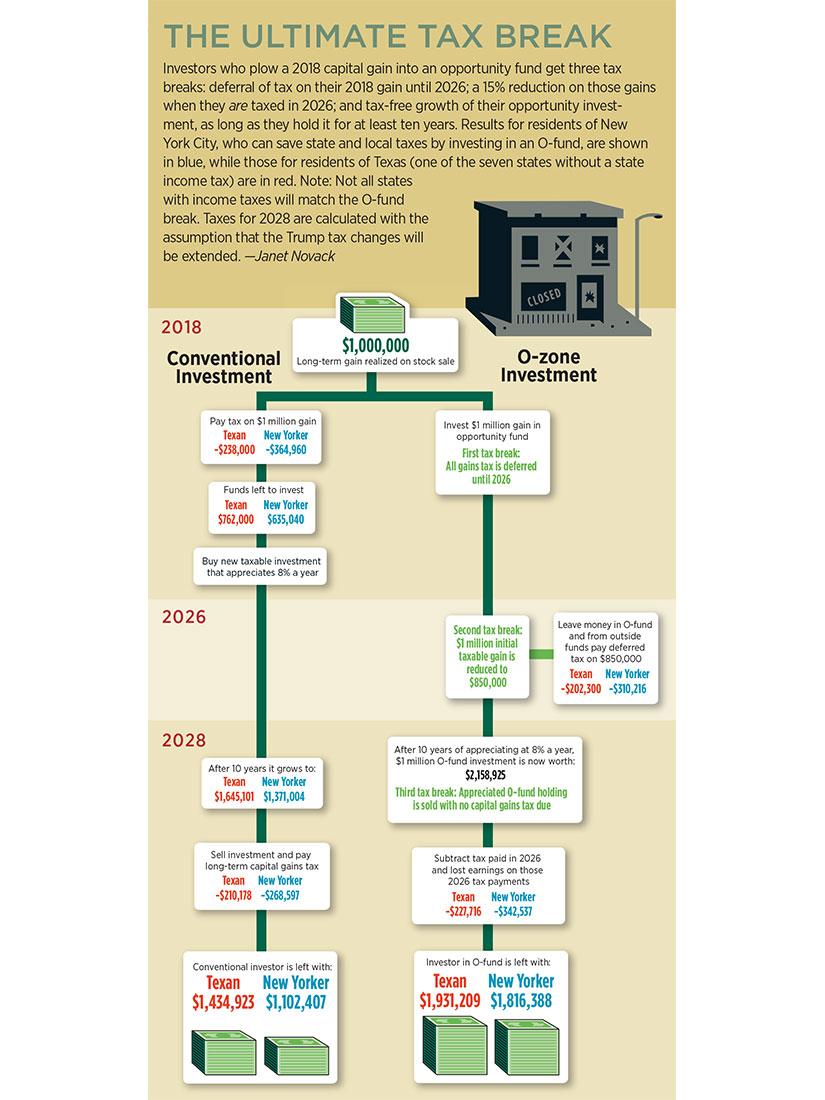

According to the IRS an Opportunity Zones (OZ for short) is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. OZ’s were added to the tax code under the Tax cuts and Jobs act under the Trump administration in 2017. Investors need to invest in a qualified investment fund, which is a special purpose investment vehicle, or a Qualified Opportunity Fund (QOF) designed to invest in a qualified OZ (QOZ). OZ investing, if and when done right are a phenomenal way to shield capital gains, especially given the recent stock market appreciation. The common perception that OZ projects happen to be markets and sub-markets in decline isn’t true either. The COVID pandemic has dramatically changed the OZ landscape and there are some truly compelling opportunities in OZ’s! Opportunity zones – Tax advantages · Defer capital gains on recently sold assets until the earlier of the sale or the exchange date of the QOF investment and Dec 31st, 2026 a.k.a 1031 on Steroids · 10% exclusion on the deferred gains on a QOF investment held for 5 years or more · 15% exclusion on the deferred gains on a QOF investment held for 7 years or more · No capital gains on the OZ investment after 10 years by virtue of a stepped up basis Opportunity zones – Things to be mindful for

Opportunity zone – Recap We found the following schematic to be a good representation of the high-level workflow when it comes to OZ investing. Please check it out here.

0 Comments

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed