|

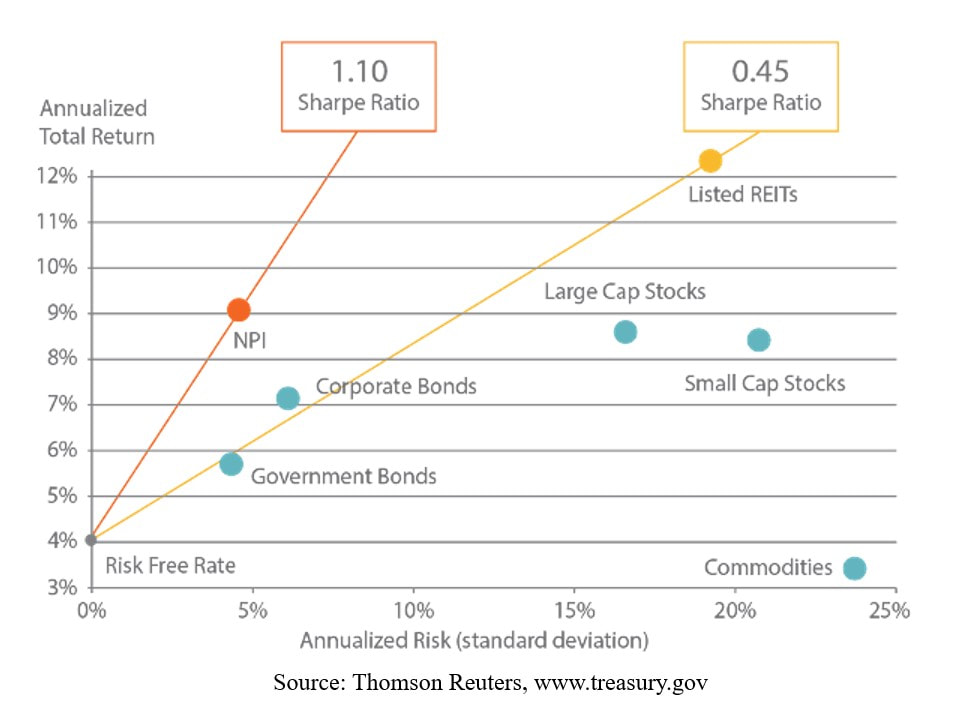

We now know why expected returns is only half of the story and its crucial to incorporate risk in the investment a.k.a. Sharpe ratio. Armed with our new knowledge of bench-marking investments on the basis of the their Sharpe ratio, we can find out which investments are truly the outperforming ones. The data is clear, Real estate (esp yield producing Real estate) was the best performing asset class over the past two decades. This may come as a surprise to many and it was clearly to us as well.

Perhaps a picture is worth a thousand words. The plot below shows the annual return on the y axis and annualized standard deviation on the x-axis for a variety of asset classes such as stocks (large cap, small cap), commodities, bonds etc. NPI is an index that tracks “operating” private commercial real estate properties held for investment purposes only. Its an index that is managed by NAREIT (National associated of Real Estate Investment Trusts). Whilst NPI includes most yield producing real estate such as office buildings and retail, multifamily apartments are a significant portion of the constitution of the index. Its interesting to see that NPI outperforms all the other asset classes. NPI index has a stock like return with a bond like risk characteristic. It is even more interesting that NPI handily beats down listed REIT’s. We will expound on the reasons in a later blog post, so stay tuned. Overall, this is great validation for us as acquirers of yield producing assets.

1 Comment

9/19/2022 06:17:33 am

Excellent and decent post. Quite knowledgeable and informative.Thanks for sharing your thoughts and ideas. Keep up this kind of effective work. You deserve a thumbs up.

Reply

Leave a Reply. |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed