|

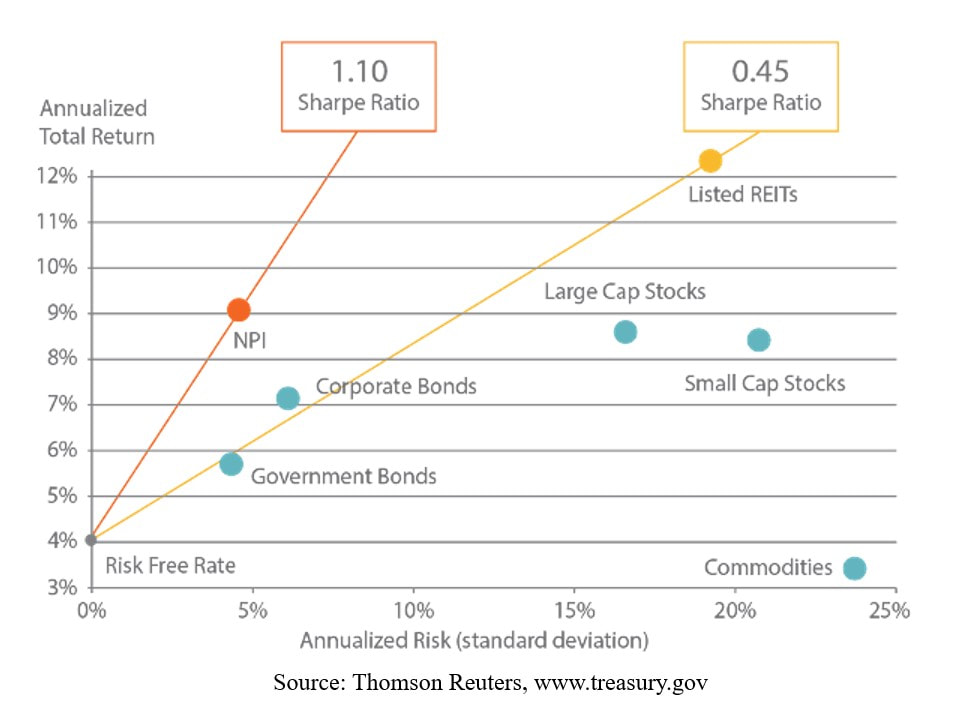

We now know why expected returns is only half of the story and its crucial to incorporate risk in the investment a.k.a. Sharpe ratio. Armed with our new knowledge of bench-marking investments on the basis of the their Sharpe ratio, we can find out which investments are truly the outperforming ones. The data is clear, Real estate (esp yield producing Real estate) was the best performing asset class over the past two decades. This may come as a surprise to many and it was clearly to us as well.

Perhaps a picture is worth a thousand words. The plot below shows the annual return on the y axis and annualized standard deviation on the x-axis for a variety of asset classes such as stocks (large cap, small cap), commodities, bonds etc. NPI is an index that tracks “operating” private commercial real estate properties held for investment purposes only. Its an index that is managed by NAREIT (National associated of Real Estate Investment Trusts). Whilst NPI includes most yield producing real estate such as office buildings and retail, multifamily apartments are a significant portion of the constitution of the index. Its interesting to see that NPI outperforms all the other asset classes. NPI index has a stock like return with a bond like risk characteristic. It is even more interesting that NPI handily beats down listed REIT’s. We will expound on the reasons in a later blog post, so stay tuned. Overall, this is great validation for us as acquirers of yield producing assets.

1 Comment

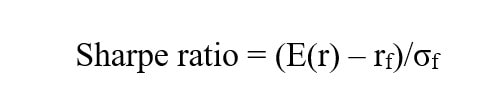

This is part 1 of a series of blogs on measuring risk adjusted return of a Real Estate portfolio. In this blog, we will focus on a fundamental concept around adjusting for risk to measure the performance of an asset – The Sharpe Ratio. What is Sharpe Ratio: As investors, obviously we care about expected return on say a given asset or across a given portfolio. Keeping everything else constant, higher expected return is better than lower, for instance. But just looking at the expected returns masks an important fundamental concept around the risk that we take to sustain that return. One way to measure the risk is to measure the standard deviation of the expected return. Without going into too much detail in this post, one measure of risk is the standard deviation of the return. An asset with a lower standard deviation has a more consistent return than the one with a higher standard deviation. A question arises, whether an investment in an asset with a expected return of 20% and a standard deviation of 10% is better than an investment with 30% expected return and 30% standard deviation. The second investment has a higher expected return but also a much higher standard deviation. This is where the notion of Sharpe comes in. Developed in 1966 by Nobel prize winner William Forsyth Sharpe, the Sharpe ratio measures the expected return of an asset relative to its risk. where E(r) = asset expected return, rf is the risk free rate and σf is the standard deviation of the excess return. As we can see expected return increases the Sharpe but standard deviation reduces it. In our contrived example, option one is a better investment despite having a lower expected return. This is due to the lower standard deviation of option one.

Limitations of Sharpe Ratio: The benefits of Sharpe ratio are obvious. Its a dimensionless way to compare asset returns paying regard to their risk. It establishes a benchmark across different assets and facilitates an objected comparison of return adjusted for risk. As it turns out, there are some limitations as well. One of the biggest limitations of the Sharpe ratio is that it assumes “normality”. Without going into too much detail this means that the return distribution is expected to follow a normal or a “bell-curve” distribution. While this is practically not true (asset returns need not be normal), it still isn’t too much of a limitation. There are other limitations of the Sharpe ratio as well related to the time-structure of the returns. We will not go in too much detail on those for the sake of simplicity. Suffices to that the Sharpe ratio is a great tool for the modern Real Estate investor to compare the relative performance across different investments properly accounting for the underlying risk and penalizing riskier investments versus lower risk ones and favoring investments with a higher expected return over the ones with a lower value. 1. Taxes will increase after stimulus bills.

During the last two months, Congress has passed more than $4 trillion in stimulus spending, with more probably on the way. Taxpayers will end up paying for this at some point. Medicare, the health insurance program for seniors, could run short of money in 2023 or sooner, as the payroll taxes that finance the program plunge amid record unemployment. Also the future retirement benefits people receive might shrink. Apartment investment is one great way to get long term tax free income and also help in offsetting your current income with the depreciation (Check with your CPA before taking tax decisions). 2. People will move from primary to secondary markets due to de-urbanization In view of future pandemics, due to social distancing requirements, cost of living de-urbanization from the high population density might happen even though its too early to predict. If you see current number of covid infected cities, they all are high population density metros/ cities. 3. Apartments fared better than other asset classes As per latest article from NMHC (National Multifamily Housing Council) the rent collections for Apartments in April are at 92% by April 26th. So Apartments which come under basic necessities fared better than other asset classes like Retail, Hotel and office which suffered really bad. 4. Stock market will have long period of volatility and low returns Top wall street forecasters predict that stock markets will deliver lackluster results because of prolonged volatility for a long time due to uncertainties. 5. Less people buying homes Because of strict criteria by banks like 700 credit score and 20% downpayment recently by Chase and other banks it will be difficult for a lot of people to buy homes. People want to have mobility due to employment shifts. New single family home constructions will slow down and other macro trends will shift people mindset to rent more. The demand for Apartments will increase a lot in future. 6. All time Low Interest rate environment Interest rates will be low for a foreseeable future which enables to get good cash flow from the apartment investments. We are carefully observing deal flow and capital markets and we hope there will be many deals that we can present to our investors. Please click on the button to view our investment opportunities so we can reach out to you and know each other and your investment criteria.

Note: I will expand and keep refining this post on a periodic basis so it's up to date

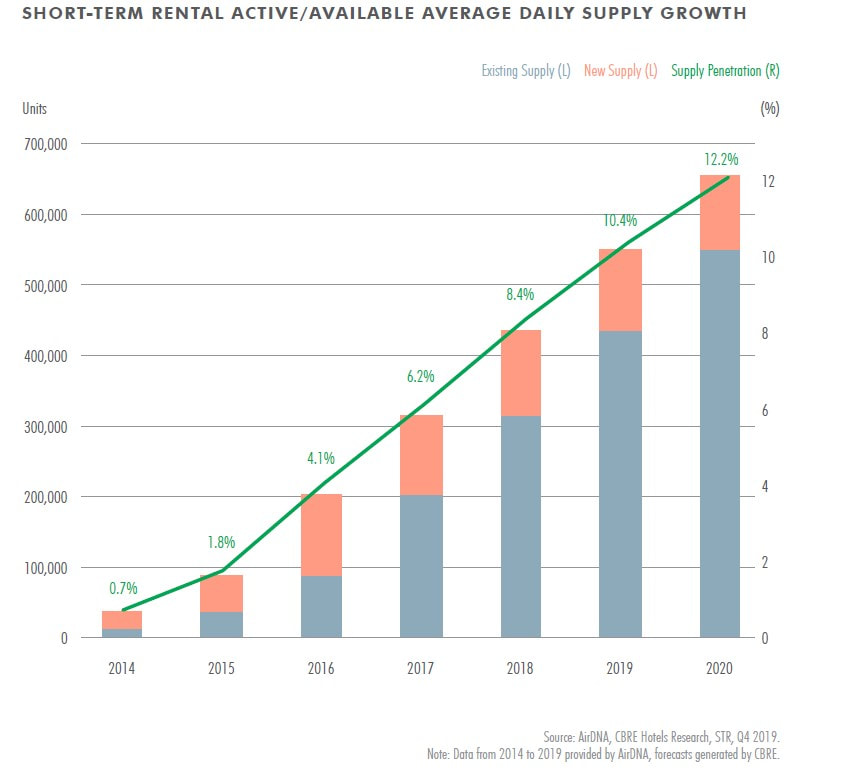

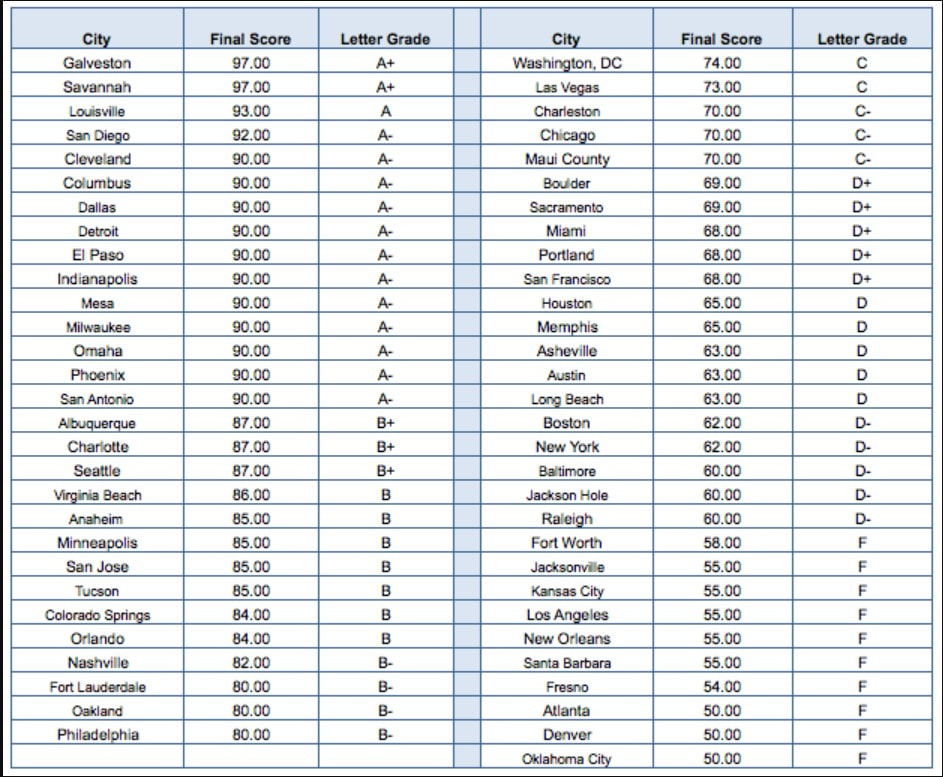

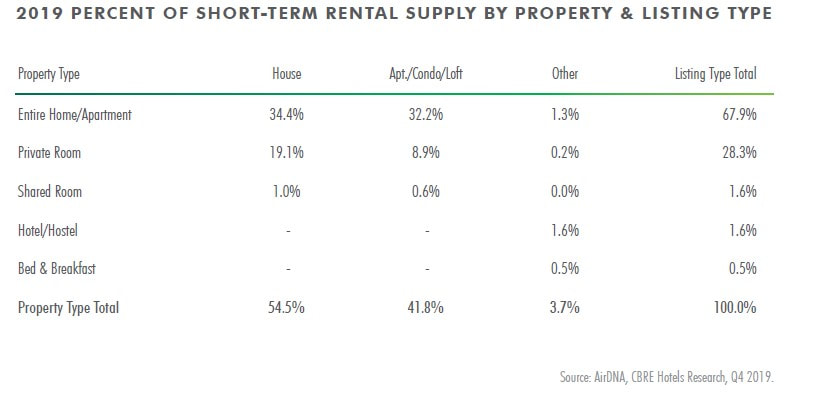

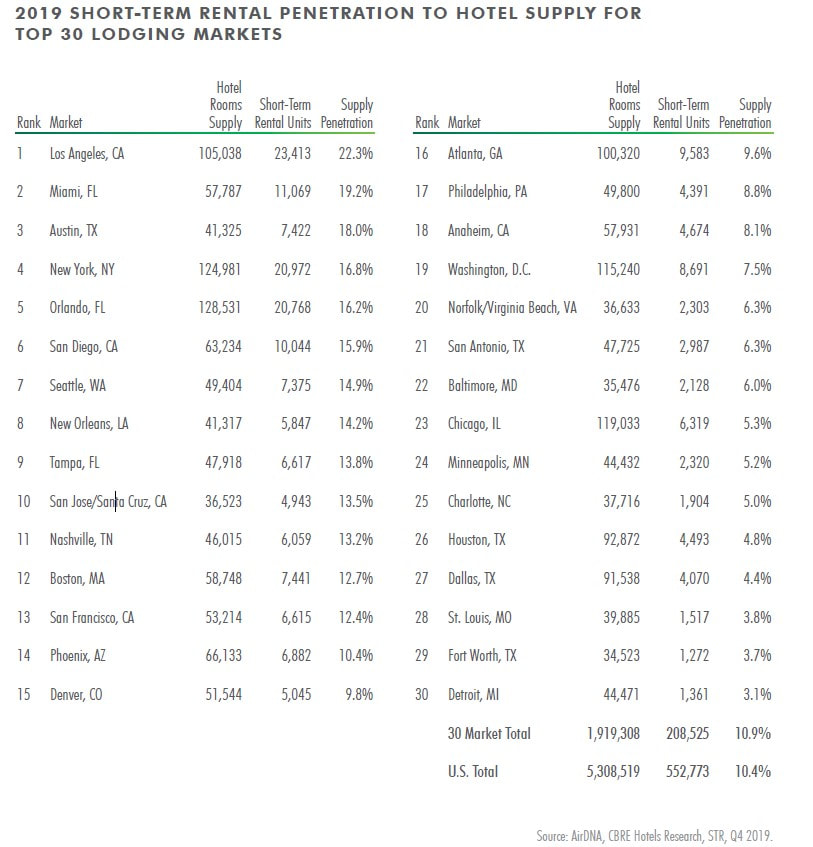

1) Low Income and Bad Demographics Mix 2) High Crime 3) Rent Roll Occupancy and Physical Occupancy don't match 4) Income in T12 and Actual Bank statements don't match 5) Flat Roofs 6) Window ACs or lack of Central HVAC 7) Wood construction issues like wood rot, decks not in good condition, WDO (Wood Destroying Organisms), Termite Damage, Stucco/ Siding issues. Overall be really careful with old wood construction. Prefer concrete block or masonry structures. 8) Water Damage inside units (Use Infrared Cameras to find out during unit walks) 9) Foundation Issues 10) Polybutylene Piping 11) Cast Iron Sewer Lines 12) Water leaks (See Pattern of water bills from past few months/ years) 13) Old Electrical Panels 14) Ignoring age of Water Heaters/ HVAC's/ Roofs while computing CapEx 15) Radon Gas 16) Retaining Walls 17) Water Intrusion 18) Railings 19) Mold 20) Asbestos and Lead Based Paint 21) Gutters, Down sprouts 22) Tree Trimming 23) They just fill in with people by giving concessions before selling. Tenants are not vetted properly and bad quality. See if there are many leases in last 3 months. 24) Always ask for seller story (We passed on several deals just because the story is not right) 25) Get Insurance Loss Runs to see any recent claims 26) Never assume existing LLC - Always do new entity 27) Go to FEMA website and verify if the property is in Flood Zone 28) Self direct IRA investments take time. So work on them first and get funds 2 weeks before closing Thanks Rama Krishna [email protected] CBRE Research did an extensive study on Short Term Rentals and it's impact on traditional Hotels. Also, STR is also getting into MultiFamily space as apartment owners are experimenting by renting 5 to 10% of the units to STR's and getting their NOI maximized ! So lets get into some things in this space and also how Zovest is trying to capture this phenomenon in MF. 1) Why guests chose Short Term Rentals (STRs) The main reasons guests chose STR vs Hotels is, the home feeling, kitchen, family setting, experience meeting new people and main factor is price. 2) Not just Airbnb First STR doesn't mean only Airbnb. There are so many other providers like VRBO, Home Away, Flipkey, Trip Advisor and also traditional corporate housing. 3) Know the local laws Laws are changing every year regarding the STR industry. It will be really difficult for operators of the STR if they only rely on STR income and underwrite the deals. What if the law changes against you and you will be in huge trouble with your money. Here is the grading that's given by Airdna and Roomscore on the markets that are best and worst in running STRs. But you need to keep upkeep on how legislature is changing. Like what happened to Newark, NJ Airbnb law that the city is trying to pass. All those people who bought the properties with high prices assuming that they can make a killing in STR are really worried. See article: “We don’t make enough money to pay double insurance and to pay extra taxes. We don’t make that kind of money,” said Airbnb host Deborah King. “It’s going to hit us hard.” 4) Exponential Growth and eating Hotel Lunch CBRE Research estimated STR's are eating 12% of Branded hotel lunch. This is huge. STR's grown 500% in last 7 years !  5) Types of properties There are different types of properties that you can do STR like Entire House, Entire Apartments, Private Room, Shared Room etc. The most popular is entire house or apartments. 6) STR and MultiFamily Doing STR in some of the units in MultiFamily is highly lucrative proposition that lot of operators are doing these days. For that

See the STR Market penetration. Zovest is already experimenting Airbnb and STR in our Cleveland Apartment Properties and we will expand to other markets and also we will build new product and carve-out few units for STR to maximize NOI.

Please reach out to me for further questions. Thanks Rama Krishna [email protected] Everyone wants to do value-add deals in Multi-Family. In my opinion these are 3 types of value-add in Multi-Family or Commercial Real Estate in general.

1) Cookie cutter value-add This is the most common one where there is some deferred maintenance but mostly interior unit renovations that lot of the times proven by the seller. The reason lot of people get into this because of the predictability of the deal. In this climate of low interest rates, so much capital chasing deals and extended economic expansion cycle, lot of people wants to do typical and safe value-add. These deals getting skinnier day by day. The cap rate are compressing, people are overpaying and it usually end up as very thin deal unless its executed perfectly. There is no margin of error in these deals. That's why sponsors are taking 15%, 18% and giving most to investors as deals are not penciling out. 2) Deep value-add Properties that are not renovated for so long time, high mismanagement, high vacancy, lot of down units, huge deferred maintenance like roofs are bad, sewer lines to be replaced, foundation issues etc where there is a lot of meat on the bone/ reward but at same time it's high risk. In most of the cases, people take bridge loans, refinance cash-out and move to long term loan. In this process they can return lot of their initial capital to investors and still keep them in deal for long term but with lower ownership for investors. 3) New construction New construction is really big value-add where you are developing from raw land to great product. Its high risk but high reward to investors and sponsorship team alike. There are lot of unknows and risk but with right structuring lot of risks can be mitigated to investors. And when you are there in all the phases of rezoning, horizontal development and vertical development, sell or lease up and manage the property you will be adding most value and pass on the value to investors. For Zovest #1 is bread and butter, but we are mostly going towards #2 and #3 these days. Please reach out to me at [email protected] for further questions, comments, feedback and ideas on what kind of value-add you typically execute or like to invest. Have a great year ahead! Thanks, Rama Krishna A typical syndicated deal for an Apartment is for a specific property. We as sponsors, identify a property (or even multiple properties) and get it under contract, do inspection, get financing and then once all the risks are removed, we raise funds from investors to close the deal and give distributions, add-value and sell at appropriate time and exit the syndication.

It's a lot of work involved and so many moving parts. Instead, we can even create a fund structure which is a blind pool, where sponsors can buy, renovate, sell properties on a periodic basis. This will help sponsors to focus on assets and not to worry too much about how to get the equity money to purchase assets. Lot of people shy away from the fund structure as investors cannot pick and choose markets/ properties to invest on. Zovest will be launching real estate fund which will largely focus on Small to Medium MultiFamily (30 to 70 units) which are ignored by large REIT's, Syndicators, Pension Funds and really a lot of work to buy, rehab, either keep for really long term or sell. If you have suggestions or interest in funds, please reach out to me at [email protected]. Thanks Rama Last month we discussed about different loan products to acquire MultiFamily Apartments which constitutes 80%+ of the volume. There are FHA (Federal Housing Administration) loans done by HUD (Department of Housing and Urban Development) Apartments Loans which have completely different set of loan terms which are not compared to any loan products out there. For example you can get up to 40 years amortization and 40 year loan term on a loan which is virtually unheard of in typical mortgage markets. If you are doing a substantial redevelopment or a brand new construction or a typical cookie cutter value-add apartment you can tap in to HUD loans. But caution, these loans are not for every one. These loans will take anywhere between 9 to 12 months and its a long and painful process. But if you get one you will be really pleased with the terms. Lets dig in more.

1) FHA/ HUD 221(d)(4) - New Construction and Substantial Rehabilitation of Apartments Substantial Rehabilitation Definition: Construction work on an existing facility is generally considered “substantial rehab” when more than $35,000 per unit in work is being completed, or two or more major building systems (plumbing, electrical, mechanical, building envelope, structural) are being replaced. The latter is determined as part of initial due diligence. In this scenario of new apartment construction or substantial rehab projects which have more than 35k per door work, you can qualify for 40 year loan term, 40 year fixed, 40 year amortized, 85% to 90% LTC (Loan to Cost), Non-recourse loan. This is extra-ordinary leverage that you cannot get anywhere in the world. Construction Interest is also capitalized in the mortgage. The permanent 40 year fixed rate term and loan amortization does not start until construction completion. The interest rate is locked prior to closing. (Current rates are low to mid 3% !!). HUD Loans are always assumable. Zovest Properties is working with our HUD Lending partners and we will be using this program in near future. Caution: These loans take anywhere between 250 to 350 days (Close to an year) and these are expensive loans. 2) FHA/ HUD 223(f) financing for typical cookie cutter value-add Apartments You can use this program to get typical value-add Apartments as well. Since the loan process takes so long, people opt for Bridge-to-HUD programs where they take bridge loan first and then exit to HUD in 12 to 18 months to hold for really long term. This program has upto 35 years term, upto 35 years amortization, fixed rate, 85% to 90% LTV, Non-recourse, assumable. Cash-out is also available upto 80% LTV. You can get upto 35k per door in rehab money as well included into the loan. Caution: These loans take anywhere between 250 to 350 days (Close to an year) and these are expensive loans. There are other creative ways to get 100% financing using HUD and LIHTC (Low Income Housing Tax Credits) Tax credits if you build affordable housing as per AMI (Average Median Income) rules. Also, HUD has really good green program (energy efficient building construction) which will provide you another 30 to 40 basis points reduction in interest rate. Please reach out to me at [email protected] so i can refer you really good providers for FHA/ HUD programs. Thanks Rama Krishna There are different loan products and also creative financing options to acquire Multi-Family Apartments. Lets go through these so as a investor you will understand what type of deals you are investing in. Every lending option will have its own pros and cons. Also these are only few popular options listed here.

1) GSE (Government-Sponsored Enterprise) loans like Freddie Mac and Fannie Mae: Freddie Mac and Fannie Mae (indirectly using their Delegated Underwriting & Services, DUS Lenders) lends to large amounts of Multi-Family Apartment Deals in the nation. These are typically non-recourse (not personally liable in case of default except for fraud and mis-representations aka bad boy carve-outs) loans with 30 years amortization, 5 to 12 year term, 1 to 6 year interest only. Loan-To-Value is around 65% to 80%. There are some options like full term interest only for 65% LTV. Interest rates are based out of 10-year treasury rate. GSE is only offered for stabilized properties. The property should have minimum of 90% occupancy in the last 90 days. Sponsors have to meet net-worth equivalent to loan amount and liquidity of 9 months of interest+principle. Loan amount has to be $1 M or above. These are extremely popular loans and in some years they exceed their quota of $100 billion per each agency much before the end of the year. There are 2 prepayment penalties Step-Down or Yield Maintenance. For example, for a 5 year loan, the Step-Down penalty to prepay the loan is 5% for first year, 4% for second year, 3% for third year, 2% for fourth year and 1% for fifth year. For Yield Maintenance, it's super expensive to prepay the loan as its almost you are married to the loan until the expiry. Unless the treasuries go really up where the lender can lend the money with higher interest, the person who took yield maintenance is on the hook to keep the mortgage till the end of the maturity date. If you have even 10% probability of selling the asset within few years of taking the loan, better opt for Step-Down penalty option. Make sure you invest in deals which you understand the prepayment penalty of that loan. 2) Commercial Bank Loans In case occupancy doesn't meet strict GSE's criteria or loan amount is too small or if you don't want to go through the process of Fannie or Freddie you can approach a local commercial bank who can lend on the Multi-Family property. Sometimes lot of investors have relationships with a local bank that they never get loans from Fannie or Freddie at all. Usually commercial banks have 10 to 25 years amortization which will reduce the cash-flow but you will be paying less interest and also paying off the loan much faster. Lot of investors who only look for wealth building and do not require cash-flow also approach local banks. These are usually recourse loans but for lower LTV they do provide non-recourse loans. Usually the guidelines are not that strict as Fannie or Freddie and also faster processing based on relationship. Interest rates tend to be higher than Fannie or Freddie loans. 3) CMBS (Commercial Mortgage-Backed Securities) Loans aka Conduit Loans These are knows as wall street loans where the loans are converted to trusts and sold to investors as packages. This is really great alternative to Fannie or Freddie loans. Where you can still get 30 year amortization, lower interest rates and non-recourse loan. LTV is capped at 75% and prepayment penalty is only Yield Maintenance or Defeasance. So you are on the hook to keep the loan more time. The advantage of CMBS loans is their rules are little lenient than Fannie or Freddie. Also their spreads on the treasury are not that high as Fannie or Freddie, so you can get better rates. Minumum is $2 Million loan amount. 4) Mezzanine Debt In conjunction with CMBS Loan or other loan products, the sponsors can get Mezzanine Debt which is a hybrid of debt and equity. Lot of Loan products like Freddie or Fannie or CMBS doesn't allow second mortgage. So Mezzanine debt can fill the gap by providing ability to convert debt to equity shares in the deal so in case of default the Mezzanine Lender is still protected and even sometimes they get preferred returns than the actual equity investors. This is really lucrative at the same time risky for the sponsors. And also passive investors need to carefully vet the deal if there is a Mezzanine Debt in the deal. This loan can the LTV to 90% of the purchase price. 5) Bridge Loans These are pretty good loans for some scenarios where occupancy is really low, lot of deferred maintenance on the property, very high rehab costs, current rents or income is really low etc. These are extremely popular but at same time this is really misused to make a deal work in some cases. You can get 80% of purchase price + 100% of rehab costs as a loan so total Loan-To-Cost is sometimes up to 86% to 90%. The term usually are 3 years with 2 year extensions. Usually non-recourse but lot of times they are recourse as well, especially on smaller loans. This product is really good for heavy or deep value-add deals where you can cash-out almost all of your money and keep the property for perpetuity if you execute the project as per the plan. If things go bad these loans become extremely risky and one end up losing all their money. Larger deals are better for Bridge loan. The origination fee and other costs add up a lot. Bridge loans are really expensive. Interest rates are usually 250 to 500 bps (basis points) above 1-month LIBOR. 6) Private/ Hard money loans Sometimes on smaller deals, people do cash-close by getting private/ hard money loans and then refinance with long term loans. You need to be extremely careful as most of the hard money loans are recourse and interest rates are between 7% to 12% with usually high origination fee. Will post about FHA, HUD and SBA loans in future blog post. Please reach out to me for more info on any loans or i can refer you to few service providers i know that can help understand multiple options. Thanks Rama Krishna [email protected] |

Archives

November 2021

Categories |

Links |

Contact Us |

|

Zovest Capital, LLC. Copyright 2020. All Rights Reserved

RSS Feed

RSS Feed